AUD / USD

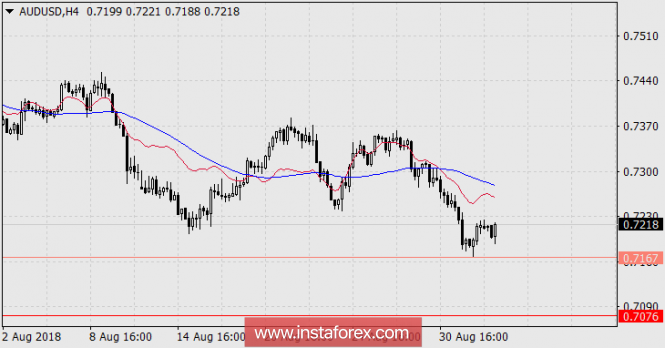

On Monday, the Australian dollar technically rebounded from the support of the trend line of the price channel and closed the day with an increase of 20 points. This morning, Australia's balance of payments for the second quarter was published. The negative balance increased from -11.7 billion dollars, and revised downwards from -10.5 billion to -13.5 billion dollars. On the data, the "Australian" stalled yesterday's growth. At 5:30 AM (London time), the Reserve Bank of Australia published the statement on monetary policy. As expected, the rate maintained at 1.50% but the RBA's official statement shows that the central bank's regulator Philip Lowe looks suspiciously optimistic. He described economic growth as "expansionist", and the prospects for the labor market was "positive." As the first reaction, the Australian dollar began to rise sharply, but we are cautious in this growth. The forecast of consulting agencies for Australian GDP for the second quarter is 0.8% vs. 1.0% in the 1st quarter, which is expected to be issued tomorrow. Also, the trade balance for July, published on Thursday, is expected to decrease to 1.46 billion dollars from 1.87 billion in June. Growth, even if it continues, has strong resistance to the trend line at 0.7240. Furthermore, we are waiting for the decline of the AUD/USD to the nearest support of the trend line within the price channel to the 0.7076 area. Opening positions is possible after fixing the price at yesterday's low 0.7167.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com