Forecast for EUR / USD pair as of September 28, 2018

Markets agreed that the rate on the euro is hasty and premature. On the second day after the rate increase by the US Central Bank, investors connected to work in this direction.

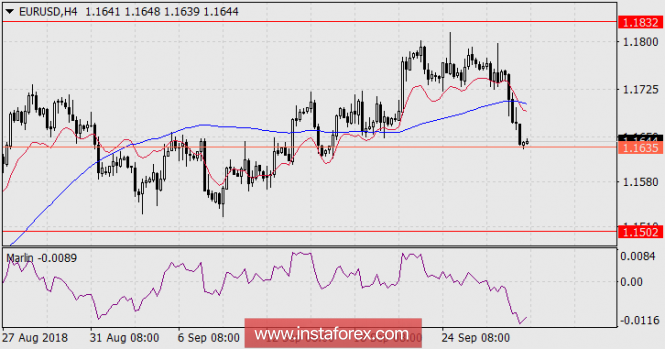

EUR / USD pair

On the second day after the rate hike, the US Central Bank investors have joined the work in this direction. The dollar strengthened on all fronts as the euro fell by 98 points, gold fell by 0.92% and a decreased in a number of commodity futures, which are most sensitive to the dollar rate (wheat, cocoa, non-ferrous metals). The US statistics came out mixed, but the main indices were quite satisfactory: the final estimate of GDP for the second quarter remained at 4.2% and the volume of orders for durable goods increased by 4.5% in August against the forecast of 1.9 %.

News from Italy came out about the delay in the adoption of the budget for the next year. Rumors of the country's intention to withdraw from the European Union grew stronger.

Today, the inflation indicators will hit the euro area as the base CPI for September is expected to increase from 1.0% to 1.1% and the total CPI is projected to be at 2.1% against 2.0% in August.

According to the US, the data on income/expenditure of consumers for August includes the expected increase of personal income to increase by 0.4% and expenses by 0.3%. On the general geopolitical background of the strengthening of the dollar, investors will prefer to work out the American data.

The first goal of the euro decrease is the support of the embedded price channel line of 1.1502.