EUR/USD has been quite impulsive with the recent bearish momentum which leads the price to reside below the trend line resistance with daily close. The positive high impact economic reports of USD published recently provided the required push for the currency to gain sustainable momentum over EUR in the process which is expected to push further lower in the coming days.

EURO has been quite mixed with the recent economic reports which did not quite help the currency to sustain the bullish momentum it had earlier. Ahead of the EURO Main Refinancing Rate to be published which is expected to be unchanged at 0.00% and ECB Press Conference to be held this week on Thursday, EURO is expected to be quite volatile and indecisive. Today EURO Sentix Investor Confidence report is going to be published which is expected to decrease to 13.8 from the previous figure of 14.7. Moreover, EURO is still struggling with the Greece issues which are expected to come to a solution very fast and Brexit issue is also expected to wrap up by the first quarter of 2019 which does indicate that EURO is going to be quite weak since the end of 2018.

On the USD side, as of the recent observation, the higher rates leading to higher inflation and increased in Jobs sector did provide the required push for the economy as well the currency to gain momentum. Though the monetary policies are suggested to be tighter how FED is going to manage that is going to be the number question for the coming days. This week US PPI, CPI and Retail Sales reports are going to be published which are expected to have mixed outcome whereas better than expected actual results may lead to further add to the impulsive gains of the USD in the process. Today FOMC Member Bostic is going to speak in Georgia about the nation's key interest rates and upcoming monetary policies which are expected to be quite neutral in nature.

As of the current scenario, the EURO is expected to struggle further to gain momentum whereas USD positive economic reports are expected to gain further bearish pressure in the process. Though upcoming economic reports are expected to have a greater influence on the upcoming price action in the pair but analyzing the fundamental facts, USD is quite ahead of EURO in the process and expected to lead the price much lower in the coming days.

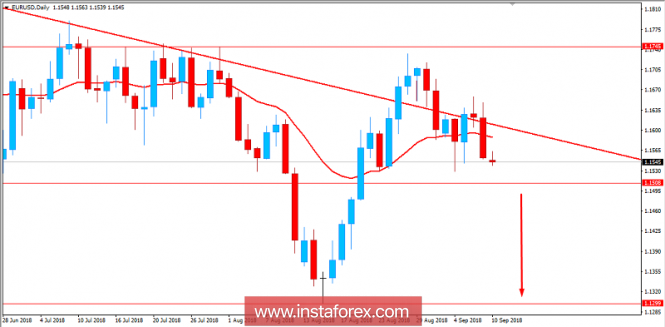

Now let us look at the technical view. The price has been quite impulsive with the bearish gains which lead the price to reside below 1.1600 area with an intention to push lower towards 1.1500 area in the coming days. Though the price has been quite impulsive with the recent bearish pressure but the decisive bearish gains are still not confirmed. So, a daily close below 1.1500 is needed for further continuation of the bearish momentum in the pair with target towards 1.1300 support area in the coming days.

SUPPORT: 1.1500, 1.1300

RESISTANCE: 1.1600, 1.1750

BIAS: BEARISH

MOMENTUM: IMPULSIVE