GBP/JPY has been volatile and corrective since the price rejected off the 149.50 area with an impulsive bearish daily close. JPY has been fundamentally quite solid recently which made the price climb against GBP, while GBP is showing weak performance in light of the recent economic reports.

Today Tokyo Core CPI report was published with an increase to 1.0% which was expected to be unchanged at 0.9%, Unemployment Rate decreased to 2.4% which was expected to be unchanged at 2.4%, Prelim Industrial Production increased to 0.7% from the previous value of -0.2% but failed to meet the expectation of 1.5%, and Retail Sales report was published with an increase to 2.7% from the previous value of 1.5% which was expected to be at 2.2%.

On the GBP side, today Current Account report was published with a decrease to -20.3B from the previous figure of -15.7B which was expected to be at -19.4B, Final GDP report was published unchanged as expected at 0.4% and Revised Business Investment report was published with a decrease to -0.7% which was expected to be unchanged at 0.5%.

Meanwhile, JPY is fundamentally quite firm, while GBP is struggling amid downbeat economic data. If JPY manages to sustain the fundamental wellness in the coming days, further bearish momentum in this pair is expected which may weaken GBP further in the process.

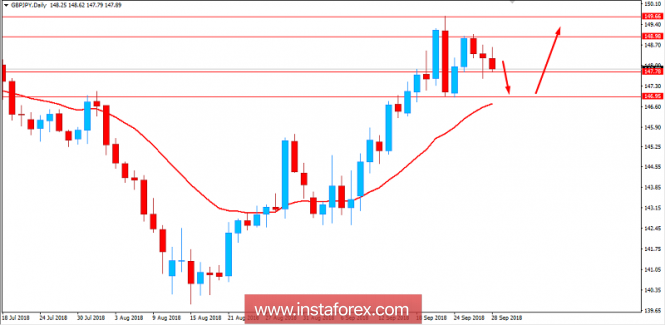

Now let us look at the technical view. The price has dropped lower quite consistently recently which could extend weakness towards 147.00 area before it starts to push higher with a target towards 149.50-150.00 resistance area. As the price remains above 147.00 area, the bullish bias is expected to continue.

SUPPORT: 147.00-80

RESISTANCE: 149.00-50

BIAS: BULLISH

MOMENTUM: VOLATILE