USD/CAD has been impulsive with the bullish momentum recently which bounced off the 1.3050 after recovering the bullish gap this week. Ahead of the high impact USD and CAD reports this week, the certain gains on the USD does indicate an imbalance in the market structure.

Recently USD has been quite positive with the high impact economic report ISM Manufacturing PMI report which showed an increase to 61.3 from the previous figure of 58.1 which was expected to decrease to 57.6. The positive economic report did help USD to gain more impulsive momentum over CAD yesterday leading to further upward pressure in the process. Today USD Trade Balance is going to be published which is expected to decrease to -50.2B from the previous figure of -46.3B. Moreover, this Friday, Average Hourly Earnings report is going to be published which is expected to decrease to 0.2% from the previous value of 0.3%, Non-Farm Employment Change is expected to increase to 193k from the previous figure of 157k and Unemployment Rate is expected to decrease to 3.8% from the previous value of 3.9%.

On the CAD side, today Trade Balance report is going to be published which is expected to decrease to -1.1B from the previous figure of -0.6B and BOC Rate Statement with Overnight Rate is going to be published which as well is expected to be unchanged at 1.50%. Additionally, on Friday, CAD Employment Change is expected to have drastic fall to 5.1k from the previous figure of 54.1k and Unemployment Rate is expected to increase to 5.9% from the previous value of 5.8%.

As of the current scenario, USD is quite hawkish than CAD with the upcoming economic reports which if the expectations are met, USD is expected to gain further momentum against CAD leading to further upward momentum in the process. Though certain negotiations with USD and CAD is going on currently which may also have certain impact on the upcoming currency market situations.

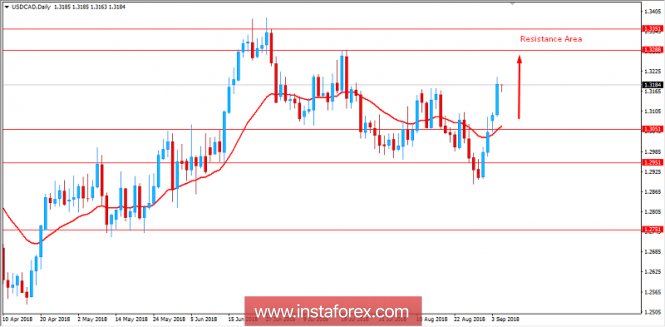

Now let us look at the technical view. The price has been quite impulsive with recent bullish pressure which is expected to lead towards 1.3280-1.3350 area in the coming days. Though the dynamic level is quite far from the current price momentum but the pressure towards the resistance area is expected to be quite non-volatile in the process. As the price remains above 1.3050 area, the bullish bias is expected to continue further.

SUPPORT: 1.2950, 1.3050

RESISTANCE: 1.3280, 1.3350

BIAS: BULLISH

MOMENTUM: IMPULSIVE and NON-VOLATILE