USD/CHF has been quite impulsive with the recent bearish pressure which led the price to reside at the edge of 0.9550 to 0.9650 support area in the process. USD has been struggling for gains amid the recent soft economic data. On the other hand, CHF is unaffected by neutral data. Meanhwile, USD is extending weakness.

This week Switzerland's PPI report was published with a decrease to 0.0% as expected from the previous value of 0.1%. As the difference is not that significant, the bearish momentum was not quite hampered in this process.

On the other hand, USD has been performing quite worse amid downbeat macroeconomic reports like PPI and CPI which made a direct impact on the market sentiment, leading to certain bearish pressure in the pair. Today US Retail Sales report is going to be published which is expected to decrease to 0.4% from the previous value of 0.5% and Core Retail Sales is also expected to decrease to 0.5% from the previous value of 0.6%.

As for the current scenario, USD has been weighed down by recent soft reports. Besides, sour forecasts for the today's macroeconomic reports encourage further bearish pressure in the pair. If the US provides better than expected reports, certain volatility and counter momentum can be observed in this in for the coming days.

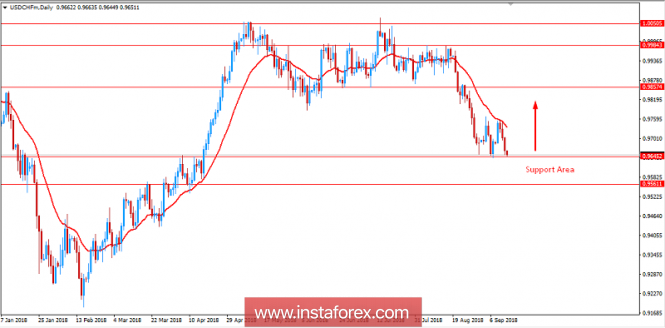

Now let us look at the technical view. The price has reached the support area of 0.9550 to 0.9650 area from where certain bullish momentum is expected with certain volatility in the market. Though the recent trend has been quite impulsive and bearish as well, certain counter momentum is expected from the support area which might be in form of retracement for further bearish momentum in the process. As the price remains below 0.9850 area, the bearish bias is expected to continue.

SUPPORT: 0.9550, 0.9650

RESISTANCE: 0.9850, 0.9950

BIAS: BEARISH

MOMENTUM: VOLATILE