USD/JPY has been quite impulsive with the recent bullish gains which lead the price to reside above 112.00 area with a daily close. Despite USD struggling against most of the currency pair recently, JPY failed to sustain the momentum it had earlier in the pair.

This week is expected to be quite volatile for the pair as both currencies have high impact economic events to affect the market momentum in the process. Tomorrow JPY SPPI report is going to be published which is expected to be unchanged at 1.1%, Monetary Policy Meeting Minutes will also be issued, and BOJ Governor Kuroda is going to speak on the upcoming policies for the Japan's economy which is expected to inject certain volatility in the pair as well.

On the USD side, this week FOMC Economic Projections, FOMC Statement and Federal Funds Rate data is going to be published. The rate is expected to increase to 2.25% from the previous value of 2.00%. As of the expectation, the rate hike is quite possible, and it might weaken USD immediately after the release. Though today there was no impactful economic reports to affect the market momentum but tomorrow USD CB Consumer Confidence report is going to be published which is expected to have a slight decrease to 132.2 from the previous figure of 133.4.

As of the current scenario, USD is quite strong in comparison to JPY ahead of the JPY's high impact economic event tomorrow whereas any positive outcome may lead to impulsive JPY gains over USD for a certain period. The pair is expected to be extremely volatile this week as of Federal Funds Rate and FOMC Statements to be published on Wednesday which is expected to impact the upcoming definite market momentum in this pair.

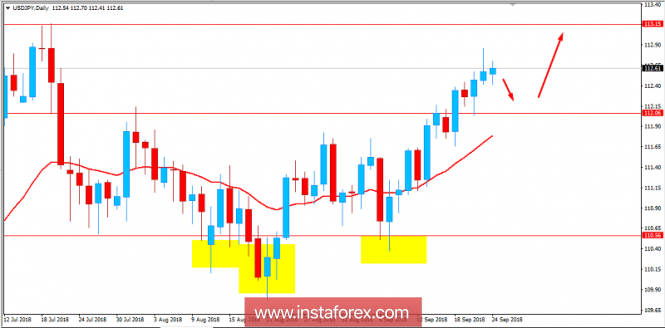

Now let us look at the technical view. The price has been slightly bullish with certain indecision with the definite momentum today which is expected to lead to certain retracement towards 112.00 area before it starts to push higher with target towards 113.00 resistance area in the future. The dynamic level is skewed upward which is expected to hold the price as support during any retracement in the process. As the price remains above 112.00 area with a daily close, the impulsive bullish pressure is expected to continue.

SUPPORT: 112.00, 110.50

RESISTANCE: 113.00, 114.50

BIAS: BULLISH

MOMENTUM: NON-VOLATILE and IMPULSIVE