To open long positions for GBP / USD, you need:

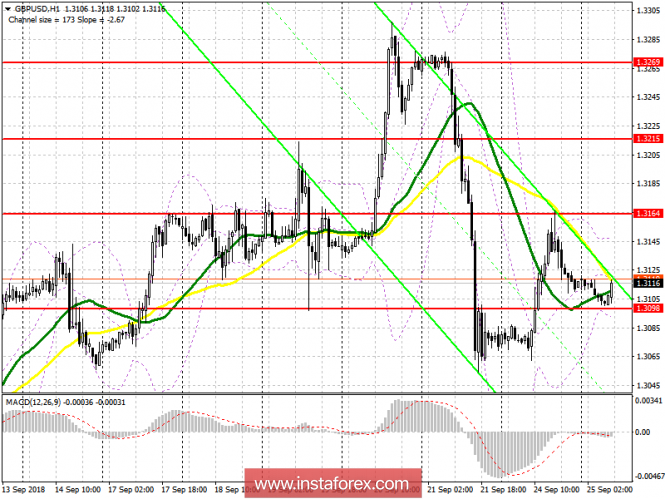

Buyers showed themselves in the support area of 1.3098, which I paid attention to in my review yesterday. While the trade is going above this range, demand for the pound will remain, and the first goal will be the highs of yesterday's 1.3164, where I recommend fixing the profits. Its breakthrough will open a direct road to the resistance area of 1.3215. In the case of GBP / USD decline today, under the support area of 1.3098, you can return to purchases only for a rebound from the low of 1.3036.

To open short positions for GBP / USD, you need:

Today, the sellers will try returning to the support area of 1.3098, which will lead to the formation of a new downward wave and the renewal of weekly lows around 1.3036 and 1.2981, where I recommend fixing the profits. In the case of another attempt by buyers to return to the market, short positions in the pound can be returned on a false break from the maximum of 1.3164 or on a rebound from 1.3215. Any news on Brexit can lead to a sharp market movement, so do not forget about the arrangement of stop orders.

Indicator signals:

Moving Averages

The 30-day moving average and the 50-day average are directed downward. Return prices under the average sliding will lead to a new formation of a downward trend in the pound.

Bollinger Bands

Volatility fell sharply. Breaking the lower boundary of the bands around 1.3098 will lead to the formation of a new downward wave in the pound.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

The material has been provided by InstaForex Company - www.instaforex.com