To open long positions for GBP/USD, it is required:

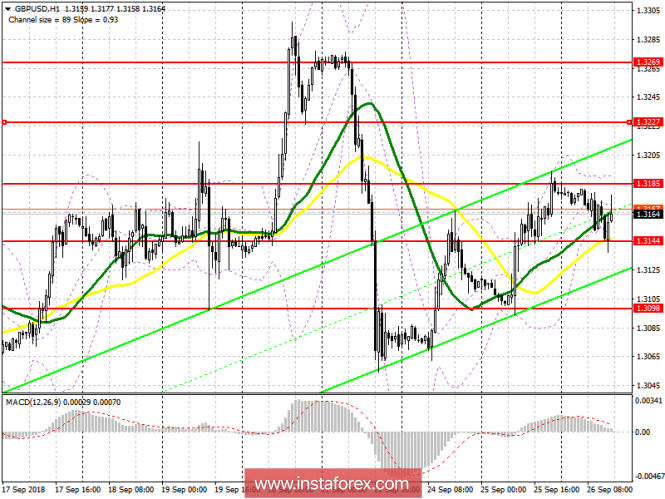

The situation did not change in the first half of the day, except for a slight decrease in the key support to the area of 1.3144. While trading above this level, buyers of the pound will search a return to the high of the day to the area of 1.3185, the breakthrough of which will resume the upward trend in the GBP/USD pair and will allow to reach the levels of 1.3227 and 1.3269, where I recommend to lock in profit. In the event of a decline in the pound on the Fed minutes, the long positions can be returned to the rebound from the support of 1.3098, or even lower, at a trough of 1.3036.

To open short positions for GBP/USD, it is required:

The repeated test of support at 1.3144 on the Fed minutes may lead to its breakdown, which will resume the downward trend in the pound and will lead to an update of the lows in the area of 1.3098 and 1.3036, where I recommend taking profits. If the upward trend in the pound continues, provided the resistance breaks 1.3185, it is best to return to short positions after the update of the weekly highs in the area of 1.3227 and 1.3269.

Indicator signals:

Moving averages

Trading again moved under the 30-day and 50-day moving average, which indicates a gradual return to the sellers market and is a signal to sell the pound.

Bollinger Bands

Bollinger bands have narrowed, indicating a drop in market volatility before the release of important fundamental data.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20