The euro fell slightly from its highs reached at the beginning of the European session on Tuesday, but demand for risky assets remains.

Mario Draghi

The speech of the president of the European Central Bank, which was emphasized on Tuesday morning, did not lead to any significant changes in the market, as it did not relate to the topic of interest rates and monetary policy of the ECB as a whole.

Mario Draghi on Tuesday urged eurozone governments to take additional measures to support the banking sector. He proposed to implement a general program of insurance of bank deposits, which will harmonize the rules of the bloc in regards to the management of bank liquidity.

Draghi also noted that the existing unified system of banking supervision and risk management performs its function perfectly, but additional measures are needed to protect the banking sector. One such measure may be a new, more effective deposit insurance system.

As I noted above, Draghi did not talk about interest rates and future plans of the ECB.

Today, we do not expect the release of important fundamental statistics, so the markets can "take a short break" before the next breakthrough. Any news related to Brexit will also lead to a significant surge in volatility in both the British pound and the euro.

The trade conflict, which continued to worsen between the US and China, does not put pressure on traders and investors. Let me remind you that the administration of the US president has announced new tariffs of 10% on imports from China worth $200 billion. New duties in the US will come into force on September 24 and by the end of the year will be raised to 25%. The Chinese authorities immediately announced their intention to introduce retaliatory tariffs on American goods.

The technical picture for EURUSD

As for the technical picture of the EUR/USD pair, most likely, the trade will move to the side channel. Large levels of support for the trading instrument can be seen in the area of 1.1645 and 1.1620, while the resistance is located in the range of 1.1700 and 1.1730. I recommend opening deals in opposite directions from these levels.

The RBA meeting minutes

The publication of the minutes of the Reserve Bank of Australia from the last meeting led to the strengthening of the Australian dollar, which last week miraculously stayed around the annual support levels, the breakthrough of which would lead to a significant medium-term downward trend.

As stated in the minutes, in the RBA's plans, raising interest rates is a more likely scenario than lowering it. However, there is currently no strong case for increasing rates in the short term. The RBA is confident that the decline in unemployment and the acceleration of inflation will occur gradually, but leading indicators indicate the growth rate of employment above average. As for the economy, Australia's GDP growth rate in the forecast period will be higher than the potential.

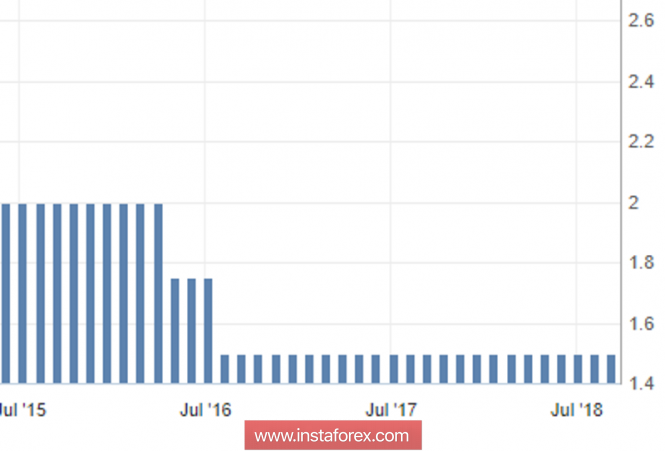

The main topic, which has recently become more and more secondary and allows the regulator to talk about it less and less, is the cost of mortgage loans. The cost is reduced compared to the same period last year, which corresponds to the low level of interest rates. Let me remind you that last year in Australia, due to the low cost of mortgage loans, there was an overheating and a sharp jump in housing prices, which could lead to another crisis.

The material has been provided by InstaForex Company - www.instaforex.com