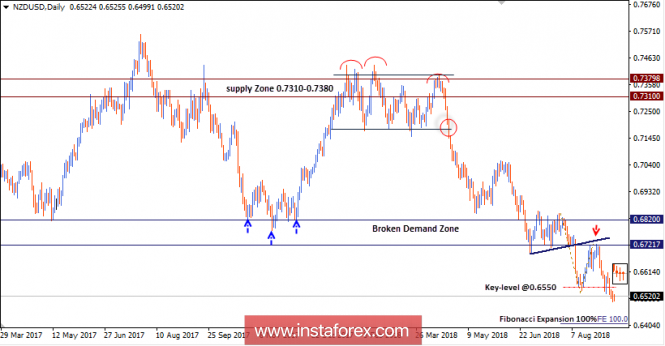

In April, bearish breakdown of 0.7220-0.7170 (lower limit of the consolidation range) allowed a quick decline towards 0.6700-0.6800 where narrow ranged consolidation range was established.

On August 9, bearish breakout below the depicted consolidation range (0.6840-0.6700) was executed. This allowed the recent bearish decline to occur towards 0.6600-0.6570.

The NZD/USD pair outlook turned to be bearish. Bearish targets are projected towards the price levels of 0.6520 and 0.6480.

Recently, signs of bullish recovery were manifested around the previous weekly/monthly low around 0.6550. This allowed the recent bullish pullback towards 0.6700 to be demonstrated.

Evident bearish rejection was demonstrated around 0.6700 (broken demand-zone and backside of the broken-trend) where the current bearish decline was initiated.

Currently, the price level of 0.6550 stands as a prominent demand-level which needs to be broken-down so that further bearish decline can occur towards 0.6420.

However, recent daily candlesticks represent lack of enough bearish momentum below 1.6550. That's why, conservative traders shouldn't consider the current bearish breakdown as a successful one. Bullish pullbacks above 0.6600 should be expected as well.

The material has been provided by InstaForex Company - www.instaforex.com