The growth of the oil market, the resumption of negotiations on NAFTA, successful talks between South Korea and North Korea, the changed rhetoric of Trump and, finally, the hawkish position of the Bank of Canada – all these fundamental factors led to the downward impulse for the USD/CAD pair, after which the Canadian strengthened to the middle of the 29th figure.

Back in early September, the loonie stormed the 1.32 mark, and many experts predicted a protracted upward trend. But the market situation changed quite quickly - the Canadian dollar began to be in demand against the background of the gradual weakening of the US currency. At the forefront of the news flow is the theme of the North American Free Trade Agreement (NAFTA). A few weeks ago, the deal between Washington and Ottawa fell through due to an imprudent phrase thrown by Trump in the presence of a journalist (that the agreement will be renegotiated only on the terms of the White House). After that, the head of the Canadian Foreign Ministry left the negotiation process, and then the Canadians refused to return to the dialogue. In the light of the planned parliamentary elections next year, current Prime Minister Justin Trudeau has to act cautiously and with caution.

Therefore, he decided to take a break in the negotiations, but not for long – just the other day there was information that the dialogue will resume on September 19, which is, today. Moreover, the head of the Canadian Foreign Ministry said yesterday that the preliminary consultations have been held recently "very intensively" – through phone calls and e-mail. But now there are those issues that need to be discussed "face to face", in connection with which the Canadian delegation has already arrived in Washington. In other words, the rhetoric of the parties is again optimistic, which allows us to talk about high chances of a deal renegotiation.

If this scenario is implemented, it will have wide consequences – not only in the context of the prospects of the downward trend of the USD/CAD pair, but also in general for the foreign exchange market. The elimination of the next hotbed of tension will reduce the general nervousness in the market, thus putting pressure on the US dollar and increasing interest in risk at the same time. Here it is worth recalling the reaction of the market when Washington made a deal with Mexico: many experts called this step a "rehearsal" of the truce with China.

However, the normalization of US-Chinese relations is still far away, although just yesterday Donald Trump said that the US is always ready for negotiations, and "at a certain stage" the parties in any case will have to make a deal. Beijing is also not eager to aggravate the situation: responding with countermeasures, the Chinese have not yet abandoned further dialogue. This, by the way, explains the dynamics of the dollar index, which after an impulsive jump (due to the growth of the yield of 10-year treasuries) again fell to the base of the 94th figure.

If we talk directly about the USD/CAD pair, the re-conclusion of the NAFTA transaction will raise the probability of an increase in the interest rate by the Canadian regulator before the end of this year. The Bank of Canada has already raised the rate twice this year, and at the last meeting made it clear about its readiness to continue the course taken.

The regulator noted positive trends in the country's economy (in particular, GDP growth and inflation, business investment indicator, exports, etc.), while noting the upbeat results of its monitoring after the tightening of monetary policy this year. Representatives of the Canadian central bank concluded that, according to their research, residents "adapted" to the higher cost of lending.

This position opens the door to another round of 25 basis point rate hikes at one of the two remaining meetings this year, the 24th of October or the 5th of December. However, in its accompanying statement, the Bank of Canada said that it is closely following the negotiations on the re-conclusion of NAFTA, as "significant changes in trade policy may have a negative impact on the Canadian economy." In other words, the deal between Washington and Ottawa will maximize the likelihood of a rate hike by the end of the year, and this causal link will provide substantial support to the Canadian currency.

The downward momentum of the USD/CAD pair is also supported by the growth of the oil market. A barrel of Brent oil reached the level of 80 dollars on the background of positive signals from Saudi Arabia. According to the American press, the Saudis expressed their readiness to allow the price of "black gold" to rise while oil traders adapt to the consequences of sanctions by the United States against Iran.

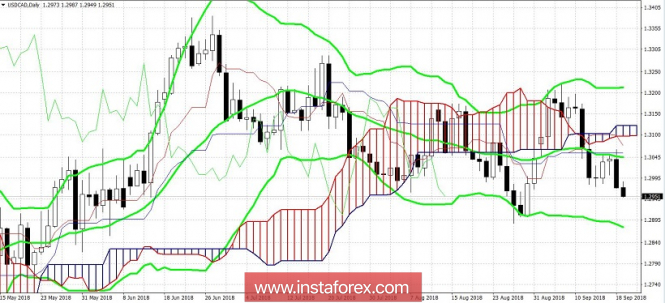

The technical picture of the USD/CAD pair also indicates a clear priority of the downward movement. This is indicated by almost all "older" timeframes - H4, D1 and W1. So, on the daily chart, the pair is on the lower line of the Bollinger Bands indicator and under the Kumo cloud, and the Ichimoku Kinko Hyo indicator has formed a bearish "Parade of lines" signal. On the weekly chart, the pair is located between the middle and lower lines of the Bollinger Bands indicator, which also indicates the priority of the south. The support level is 1.2880 - the lower line of the Bollinger Bands indicator. But the resistance level is the price of 1.3050 - this is the average line of the above indicator on the daily chart.

The material has been provided by InstaForex Company - www.instaforex.com