Investors continue to receive contradictory signals, which makes them continue to be cautious.

On the one hand, this is the uncertainty of the prospects for resolving the trade crisis between the US and China, and on the other, contradictory data from economic statistics that do not allow the US dollar to continue its notable growth, and to turn down.

If investors still hope that a trade compromise between Canada and the EU, on the one hand, and the US on the other, will be achieved, the prospects for a positive resolution of the contradictions between the states and China are as yet unattainable. This is the main reason that influences the behavior of markets, whose participants fear that the growth rate of the world economy can not only slow down, but also start to decline, which in the long run will have a wide negative impact on the demand for commodity and raw materials assets and, of course, shares of companies. In this case, we should expect an increased demand for defensive assets, including the US dollar.

As for the impact of the data on economic statistics from the United States on the prospects for the US dollar, they are contradictory, but they are unlikely to force the Fed to abandon the process of continuing to raise interest rates.

So, on Friday were published the values of the index of retail sales, as well as their volume for the month of August. The data showed braking of the indicators, which had local pressure on the dollar, as many in the market probably decided that this was an important signal, together with the weak consumer inflation figures released earlier, which could call the Fed to pause the interest rate increase if not in this month, then closer to the end of the year, for sure.

According to the data, the base retail sales index in August fell sharply in growth to 0.3% from 0.9% in July. The volume increased by only 0.1% against a convincing growth in the previous month by 0.7%. In addition, the values of export and import price indices became negative, which respectively fell by -0.1% and -0.6%. These data caused a local weakening of the dollar, but then presented figures of the consumer sentiment index from the University of Michigan, which showed growth to 100.8 points versus 96.2 points, compensated this negative and allowed the dollar to finish trading on Friday in positive territory.

Estimating the overall market picture, we continue to believe that the overall lateral dynamics in the currency market in pairs with the US dollar will continue, with the exception of commodity currencies - Australian and New Zealand dollars, which may resume the downward trend. This is due to the expectation of an increase in interest rates by the Fed this month and the lack of progress in the negotiations between the US and PRC on trade.

Forecast of the day:

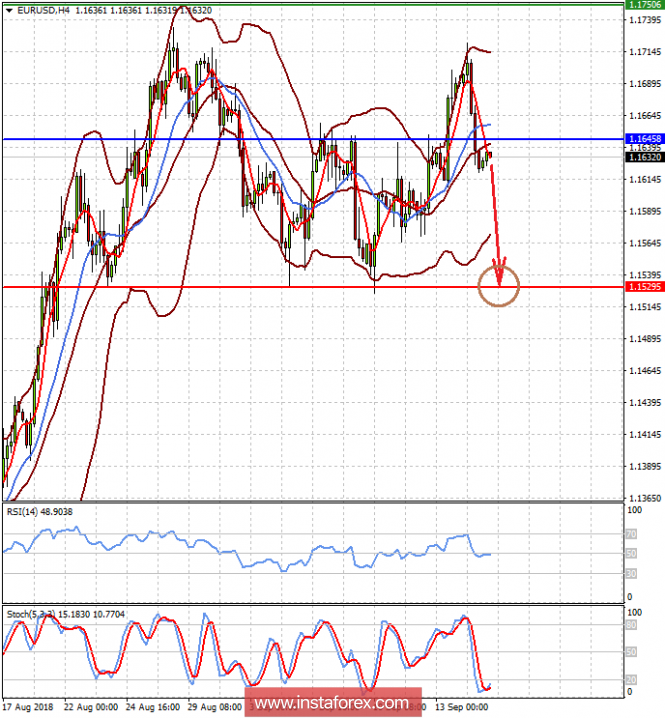

The EUR / USD currency pair is trading below 1.1645 amid expectations of publication of data on consumer inflation in the euro area. If the price is kept below this level on the wave of absence, the growth of inflationary pressure in the eurozone, then there is a probability of its local decrease to 1.1530.

The AUD / USD currency pair is trading below the 0.7170 level. The pressure on the pair is made by the lack of progress in the negotiations between the US and China on trade. If the pair does not rise above this mark, it may continue to decline to 0.7100.