Gold continues to sleep peacefully near the $1200 per ounce mark, but it is unlikely that an experienced investor will be deceived by such calmness. The market is cyclical, trends are replaced by consolidations, trading ranges give way to new trends, so the current sleepy state will probably end soon. We need a reason to wake up. And they are quite capable of becoming the events of the end of September. The Fed meeting, the publication of the draft budget of Italy and the release of data on European inflation will directly affect the USD index, and in fact its dynamics has become the main "bearish" driver for the XAU/USD. Since the beginning of the year, the precious metal has lost about 8% on expectations of an increase in the Federal funds rate and on fears of increased trade tensions.

Despite low prices, physical demand does not support gold. Stocks of the largest specialized stock exchange fund SPDR Gold Shares fell to 742 tons, the lowest level since February 2016. Since the beginning of the year, the figure has lost 11.2%. Rumors of an increase in import duties in India from the current 10% to 12-13%, and possibly up to 20%, increase the risks of reducing demand for precious metals in the country - its largest consumer. At the same time, the People's Bank of China has not purchased gold for two years in order to increase its reserves. However, the holy place is never empty: Russia has claimed the status of the largest buyer, increasing its own reserves to 64.3 million ounces (about 2000 tons). In August, they rose by 31 tons. Bloomberg reports that the official Delhi will leave tariffs at the same level, as it fears an increase in smuggling, and ETF stocks tend to follow the price, and not vice versa.

I believe that the market conditions of the physical asset will gradually improve, and to predict the further dynamics of the XAU/USD it makes sense to look at factors such as trade wars and FOMC meetings. During the current cycle of normalization of monetary policy of the Fed, gold reacted quite clearly to the increase in the Federal funds rate: on the eve of the meetings, it fell, then quickly restored the lost positions. In my opinion, this dynamics is due to the implementation of the principle of "sell on rumors, buy on facts".

Dynamics of gold and Fed rate

The failure occurred in June, when the tightening of monetary policy did not lead to an increase in the value of the precious metal. In summer, investors were keen on buying the US dollar amid divergence in economic growth between the United States and other countries. They believed that China and the developing countries would slow down, while Washington would not feel the pain of trade wars. Currently, the world has changed. The US economy may lose momentum, while EM assets look oversold. In this respect, the former associated with the recovery of gold prices after the FOMC meetings is quite capable of playing.

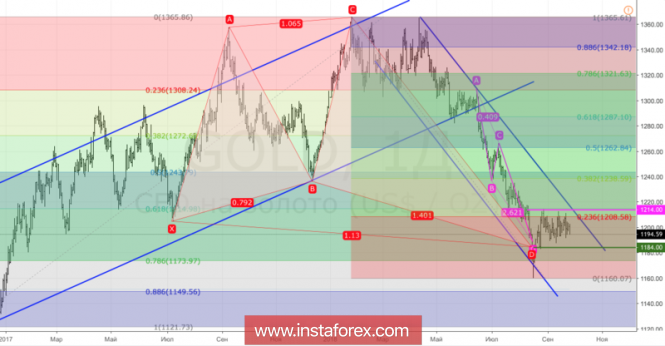

Technically, the exit of the precious metal from the trading range of $1184-1214 per ounce will allow it to determine the direction of further movement. The breakout of the upper limit will increase the risks of the rally in the direction of $1240 and $1260. On the contrary, a successful storm of support for $1184 will open the way for the "bears" to the south.

Gold, daily chart