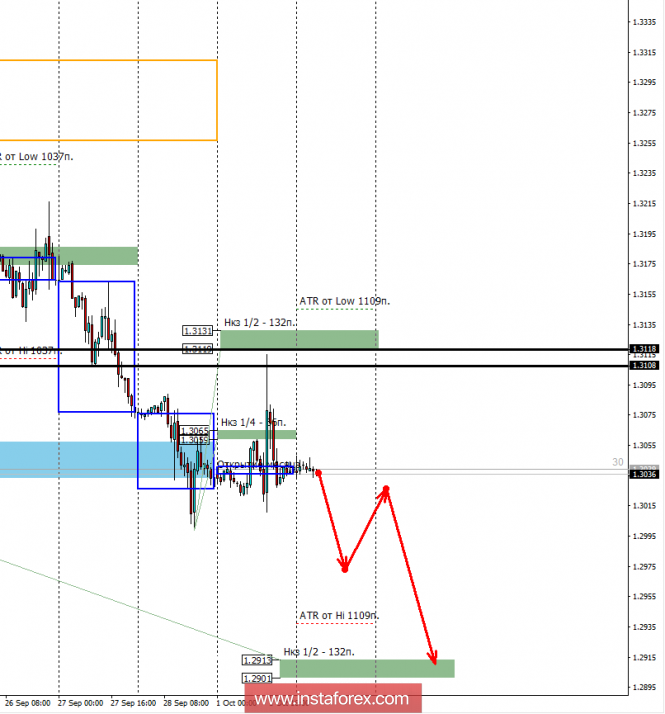

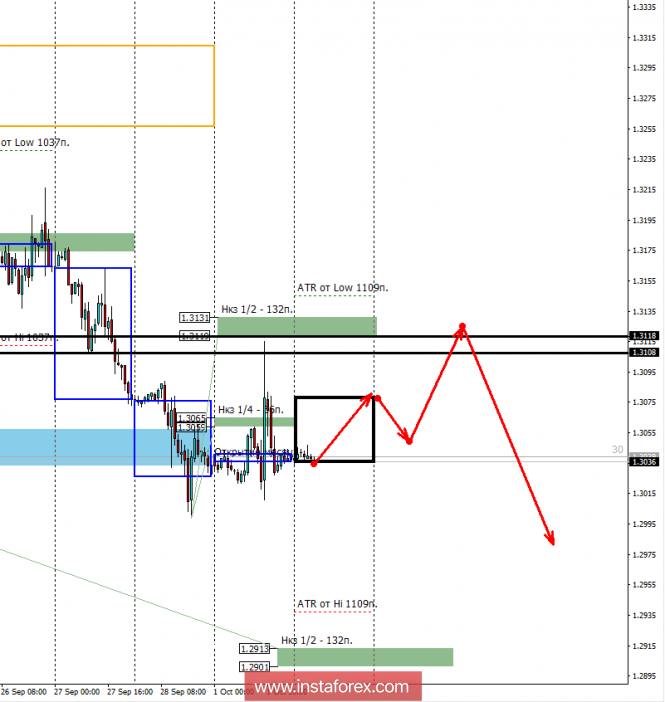

In the second half of last week, the implementation of the priority downward model continued. On Friday, the pair reached the weekly short-term of 1.3057-1.3033, which led to the emergence of demand and the formation of a corrective model.

Yesterday, the pair formed a corrective growth model, which made it possible to get favorable prices for selling the instrument from a significant resistance level of 1.3108. The instrument continues to trade below the NKZ 1/2 1.3131-1.3119, which indicates a bearish priority. The nearest target of the fall is NKZ 1/2 1.2913-1.2901. This indicates a profitable risk-earnings ratio for any sales from control areas that are resistance.

When working within the medium-term bearish momentum, it is necessary to abandon attempts to find prices to buy the instrument, since the probability of updating the weekly low is 70%, which makes purchases unprofitable.

The formation of the accumulation phase will require the closure of today's US session to be above the NKZ 1/4 1.3065-1.3059. This will allow us to consider the re-growth to the NKZ 1/2, where the most favorable selling prices can be obtained. Since on Friday the closing of the US session was below the weekly short-term, the probability of a decline to the level of 1.2913 increased to 70%. Intraday trading plans should take this fact into account.

Day short - day control area. The zone formed by important data from the futures market, which change several times a year.

Weekly KZ - week control area. The zone formed by the important marks of the futures market, which change several times a year.

Monthly KZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com