The European currency maintains its gradual growth amid fears related to the US stock market, which also puts pressure on the US dollar.

The minutes of the ECB

Today's report of the European Central Bank since the last meeting on monetary policy supported the European currency, even though it was about debt problems.

In the ECB minutes, the leaders called on eurozone countries with high debt levels to take measures to reduce it. The central bank warned that high government spending could undermine the stability of the currency bloc.

Most likely, such a call was sent to the Italian authorities, where the government is preparing to submit its budget plans for 2019. Let me remind you that the government set the target for the budget deficit for 2019, 2020 and 2021 at 2.4% of GDP, thereby increasing spending. This caused a negative reaction of the European Union, after which the government announced its readiness to reduce the target deficit in 2020 and 2021.

The minutes of the ECB was also focused on the fact that the increase in government spending during a period of high economic growth in the future will affect the sustainability of the eurozone.

With regards to interest rates and the asset repurchase program, there are no significant changes. The report indicates that the European Central Bank will continue to follow the plan, despite the growing economic risks and the threat of protectionism.

Today, the German government lowered its GDP growth forecast, but the market ignored this report. According to the data, the economy is projected to grow only 1.8% in 2018, not 2.3%, as previously stated. The German government also reduced its forecast for GDP growth in 2019 to 1.8% from 2.1%.

The forecast for the growth of private consumption, which is the main driver economically, was also revised negatively to 1.7% in 2018 and to 1.9% in 2019.

The report on the US labor market, where the number of Americans applying for unemployment benefits for the first time increased, had a negative impact on the US dollar, even though the market remains at record low levels.

According to the US Department of labor, the number of initial applications for unemployment benefits for the week from September 30 to October 6 increased by 7000 and amounted to 214,000. Economists had forecast the number of applications to be 208,000.

Inflation in the US

Inflation in the US showed less significant growth than economists had expected, which may affect the Federal Reserve's desire to further increase interest rates.

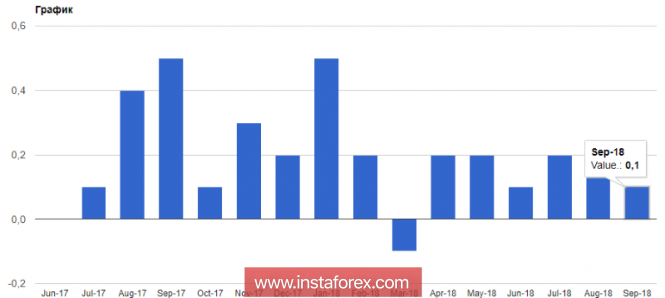

According to the data, the CPI consumer price index in the United States in September this year grew by only 0.1% compared to August, while economists had forecast an increase of 0.2%. As for core inflation, prices excluding food and energy in the US also rose 0.1% in September, while economists had expected a 0.2% rise.

The main slowdown in the index is due to energy prices, which in September this year fell by 0.5% in the United States, while food prices remained unchanged.

Real weekly earnings in the US increased by 0.2%.

The consumer price index in the US in September rose 2.3% compared to the same period last year, and annual inflation in July was 2.9%

As for the technical picture, the bullish momentum will significantly decrease when the pair reaches the highs around 1.1590, and therefore I do not recommend to rush into opening long positions in this range. More optimal levels for the purchase of euros will be located in the support area 1.1540 and 1.1490.

The material has been provided by InstaForex Company - www.instaforex.com