Data on unemployment in the eurozone slightly supported the European currency, which managed to return to daily highs, unsuccessfully trying to update them. However, a weak report on the production sphere did not allow buyers to build a larger upward correctional wave.

Basic data

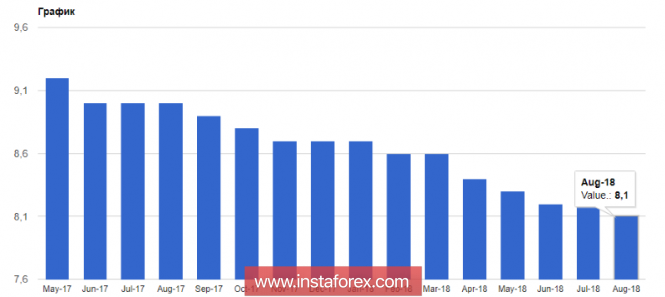

According to the statistics agency of the EU, the unemployment rate in the euro zone fell in August of this year. This happened due to the gradual recovery of the eurozone economy in the 3rd quarter of this year, which leads to the creation of new jobs.

Thus, the number of unemployed in the eurozone in August 2018 decreased by 102,000 compared with July, while the unemployment rate was 8.1% versus 8.2% in the previous month.

The eurozone economy is expected to continue its growth amid a slowdown in exports due to good and steady growth in retail sales and accelerated wage growth.

Today, a report was issued in which the forecast for the manufacturing sector for the next year in Germany was lowered. According to a survey of industrial companies, the uncertainty of the future of international trade was the main reason for the revision of expectations. According to the IHS Markit, the final PMI purchasing managers index for the German manufacturing sector in September of this year fell to 53.7 points, fully coinciding with economists' forecasts.

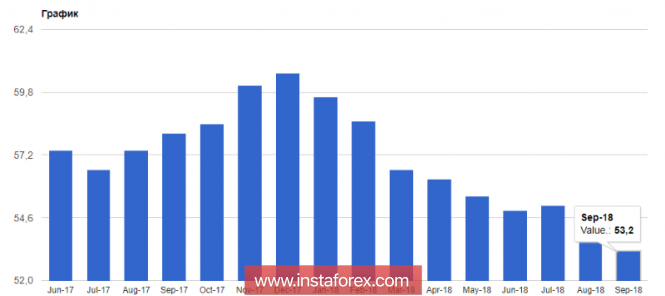

Given the decline in the index of the manufacturing sector in Germany, which is the flagship of the European economy, it is not surprising that the index of purchasing managers for the manufacturing sector of the eurozone also dropped.

According to the IHS Markit, the purchasing managers index for the Eurozone production sector in September dropped to 53.2 points from 54.6 points in August. Economists had expected the index to decline to the level of 53.3 points. Let me remind you that, despite the slowdown in activity, the value above 50 points still indicates its growth.

As for the technical picture of the EUR / USD currency pair, it remained unchanged compared with the morning forecast.

The pressure on the euro fell slightly, allowing buyers to reach the resistance area of 1.1615. However, I expect that larger sellers will manifest themselves after building the upper boundary of the downward channel, which, in my opinion, will take place in the resistance area of 1.1650. In this regard, it is best to return to short positions after the correction from a maximum of 1.1630 and 1.1650.

Brexit will continue to put pressure on the pound

The British pound rose slightly against the US dollar, and the sellers did not reach the lows of last week after data that consumer lending on credit cards in the UK rose in August, which will necessarily lead to higher costs and support economic growth rates, which are now in the UK remains at an extremely low level.

According to the Bank of England, net lending on credit cards in August rose to 1.1 billion pounds, compared to 0.8 billion pounds in July. Economists had expected unsecured lending to reach 1.4 billion pounds. The number of approved mortgage loans in August increased compared with July, to 66,440.

It is necessary to pay attention to the fact that the further prospects for the growth of the pound from the current attractive support levels remain rather fragile.

Until then, while confidence in the conclusion of an agreement on Brexit does not grow, talking about the end of the bearish trend in the British pound will not be entirely correct. Even if it is possible to agree on the terms of the transaction, it will still have to be approved by the parliament, where it is unlikely that enough votes will be gained for its approval.

The material has been provided by InstaForex Company - www.instaforex.com