To open long positions on EUR / USD you need:

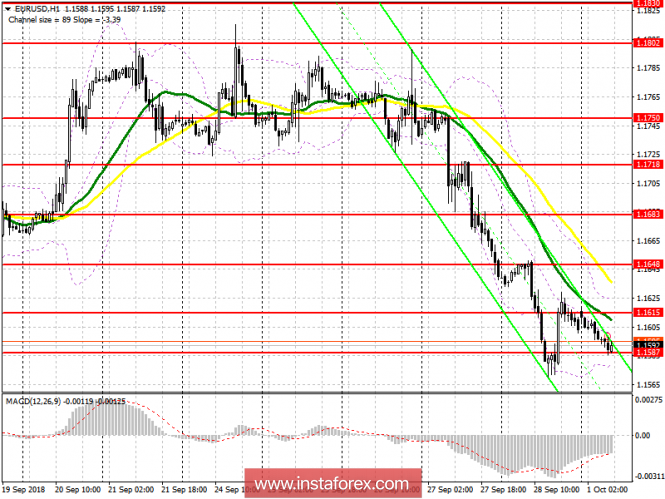

The Friday's inflation data led to a further decline in the euro, but in the second half of the day, there was a fixation of profits. At the moment, buyers need to stay above the level of 1.1587 or create a false breakdown on it, which will be a signal to open long positions in EUR / USD with a view to returning to the resistance level of 1.1615, consolidation on which will lead to growth in the area of the high of 1.1648, where I recommend fixing the profit. In the case of a further decline in the euro on the trend, you can go back to purchases after updating the minimum of 1.1556 or rebound from 1.1528.

To open short positions on EUR / USD you need:

The repeated support test of 1.1587 will lead to the breakdown of this level with the formation of a signal for the sale of the euro. The bears will try to update the low of last week with the test of the area of 1.1556 and the exit at 1.1528, where I recommend fixing the profit. In the case of EUR / USD growth in the first half of the day, you can look at short positions when forming a false breakout in the resistance area of 1.1615 or on a rebound from the high of 1.1648, where the upper limit of a new downward channel will be formed.

Indicator signals:

Moving averages

The 30-day moving average and 50-day average are directed down, which indicates a continued decline in the euro in the short term.

Bollinger bands

The euro can be supported by the lower limit of the indicator Bollinger Bands, which is located in the area of 1.1579. However, its breakdown will lead to a new wave of decline.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

The material has been provided by InstaForex Company - www.instaforex.com