To open long positions on EUR / USD, you need:

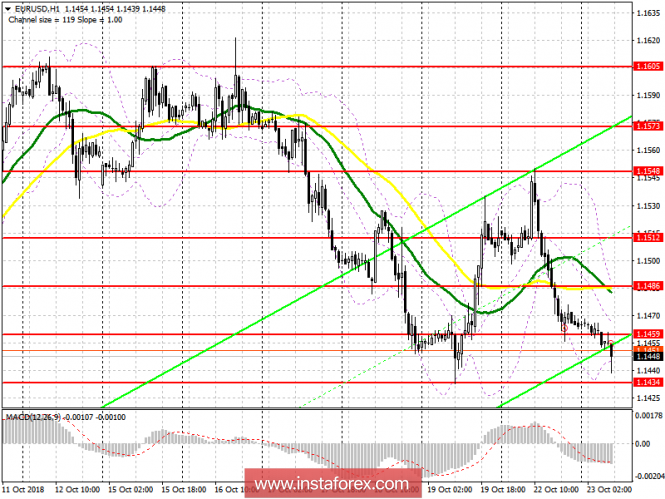

The political crisis of the EU due to a sharp change in the course of Italy puts pressure on the euro, which returned to the lows of last week. The White House is also here with its pressure on duties and trade agreements. At the moment, the buyers' task is a breakthrough of the level of 1.1459, above which you can count on the resistance update near 1.1486, where the 50-day moving average is located and where I recommend fixing the profit. In the case of a decline below the support level of 1.1434, without forming a false breakdown there, since this will be the third test in a row, it is best to open long positions in EUR / USD after updating the minimum of 1.1397 and 1.1351.

To open short positions on EUR / USD, you need:

Euro sellers are required to form a false breakdown and return to the resistance level of 1.1459, which will be the first signal to open short positions. Repeated test of support for 1.1434 will lead to a larger sale of EUR / USD with access to monthly minimums in the area of 1.1397 and 1.1351, where I recommend fixing the profits. In the case of growth above the resistance of 1.1459 in the first half of the day, you can sell the euro to rebound from a maximum of 1.1486.

Indicator signals:

Moving Averages

Trade has moved below the moving average, which indicates a resumption of the downward trend after the Friday correction.

Bollinger bands

The upper limit of the Bollinger Bands indicator near 1.1486 may limit the upward potential. A retest of the lower limit around 1.1445 will be a direct signal to sell the euro.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20