To open long positions on EUR / USD, you need:

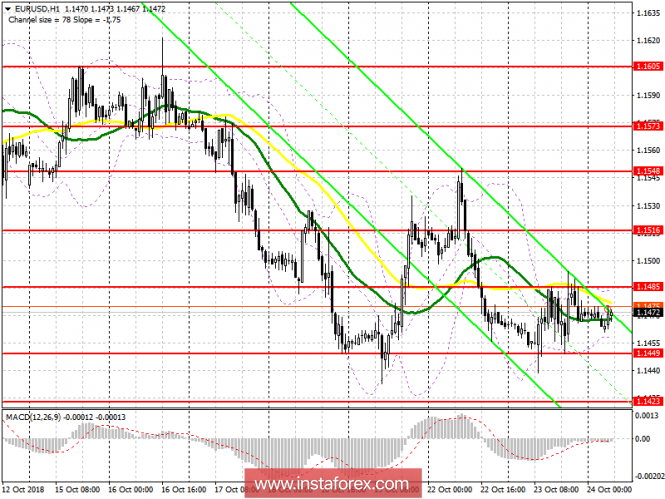

As long as the trade is conducted above the level of 1.1449, the demand for the euro will continue. However, the main task is to break down and consolidate above the resistance of 1.1485, which was not possible to do yesterday throughout the day. Only after that can we expect a larger upward trend with a test of new highs in the region of 1.1516 and 1.1548, where I recommend fixing the profits. In the event of a decline in the euro under the support level of 1.1449 in the first half of the day, it is best to return to long positions to rebound from a new minimum of 1.1423.

To open short positions on EUR / USD, you need:

Sellers still need to keep the pair below the resistance level of 1.1485, and the formation of a false breakout on it will be an additional signal to open short positions in the euro in order to update the new weekly lows around 1.1423 and 1.1397, where I recommend fixing the profits. In the case of growth above 1.1485 and going beyond the limits of the side channel, it is best to return to short positions in EUR / USD on a rebound from the resistance of 1.1516.

Indicator signals:

Moving Averages

Trade has moved one level with the average moving, which indicates the further formation of the lateral nature of the market.

Bollinger bands

The upper limit of the Bollinger Bands indicator around 1.1485 may limit the upward potential. A retest of the lower limit around 1.1455 will be a direct signal to sell the euro.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20