To open long positions on EUR / USD, you need:

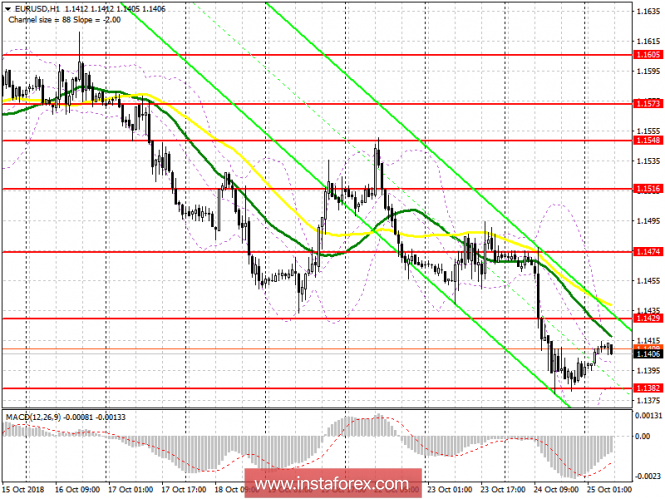

All attention to the ECB decision on interest rates and a press conference at which a change in the course of the credit policy can be announced. It is best to return to purchases in the first half of the day when a false breakdown is formed in the support area of 1.1382 or to rebound from a minimum of 1.1351. The main task of the buyers will be to consolidate above the resistance of 1.1429, where the 50-day average is located, which will lead to a larger correctional growth in the maximum area of 1.1474, where I recommend fixing the profits.

To open short positions on EUR / USD, you need:

Sellers need to form a false breakdown at the resistance level of 1.1429, which will be a signal to open short positions in the euro in order to update yesterday's lows in the support area of 1.1382. The breakthrough of this range will increase the pressure on the euro, which will lead to a test of levels of 1.1351 and 1.1299, where I recommend fixing the profits. However, such a variant of events can occur only under a negative scenario from the ECB. In the case of growth above the resistance level of 1.1429 in the first half of the day, short positions can be returned to the rebound from the level of 1.1474.

Indicator signals:

Moving Averages

Trade is conducted under the 30- and 50-day average, which indicates the bearish nature of the market.

Bollinger bands

The upper border of the Bollinger Bands indicator in the 1.1418 area limits the upward potential, and the breakdown of the lower border in the 1.1382 area will be a direct signal to sell the euro.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20