AUD/USD has been quite bullish with the recent momentum, reversing from the long-term bearish trend since January 2018. AUD recently gained momentum in light of mixed economic reports while USD is struggling for gains amid recent disappointing data.

AUD gained momentum as most economic reports published recently came to expectations. Today Australia's Employment Change report was published with a decrease to 5.6k from the previous figure of 44.6k which was expected to be at 15.2k and Unemployment Rate had a positive outcome with decrease to 5.0% which was expected to be unchanged at 5.3%. Moreover, NAB Quarterly Business Confidence report was published with a decrease to 3 from the previous figure of 7.

On the other hand, after the worse-than-expected CPI and Retail Sales reports from the US, USD failed to sustain the momentum it had had over AUD earlier. Though certain economic reports performed quite well on the USD side, the greenback failed to grab attention of market participants to continue with the trend against AUD. Today US Philly Fed Manufacturing Index report is going to be published which is expected to decrease to 19.7 from the previous figure of 22.9, Unemployment Claims are expected to decrease to 211k from the previous figure of 214k, CB Leading Index is expected to increase to 0.5% from the previous value of 0.4%, and Natural Gas Storage is expected to decrease to 85B from the previous figure of 90B. Though USD is struggling to gain momentum, FED has recently confirmed its intention for gradual monetary tigthening. So, the US central bank is ready for another rate hike this year, fting the official funds rate to 2.50% from the current value of 2.25%.

Thus, the US FED is currently poised to continue rate hikes. Such a fast pace of rate hikes is likely to strengthen USD but, on the minus side, may cause a slowdown in the US economy in the long term. At the same time, AUD is set to extend gains that is expected to push the pair higher against USD in the coming days.

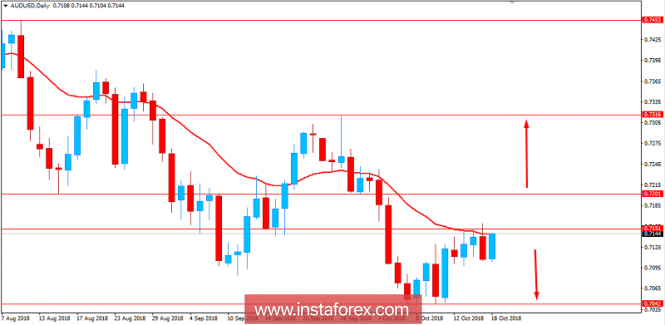

Now let us look at the technical view. The price is currently quite impulsive with the bullish gains which makes the price hold at the edge of 0.7150-0.7200 area. Though the price is being held by the dynamic level of 20 EMA as well, there are certain chances of a bullish counter-move in the coming days. As the price breaks above 0.7200 area with a daily close, further bullish momentum is expected in this pair. On the other hand, being below the area indicates the continuation of the bearish bias with a target towards 0.7050 support area.

SUPPORT: 0.7050

RESISTANCE: 0.7150, 0.7200

BIAS: BEARISH

MOMENTUM: VOLATILE