USD/CAD has been quite volatile, keeping the bullish momentum which encouraged the price to push higher above 1.3050 area with a daily close. Ahead of several macroeconomic reports on Friday from the US and Canada, the pair is facing choppy trading.

USD has been quite strong amid the economic reports published today which helped the currency to assert its strength despite bearish pressure throughout the day. Today US CB Consumer Confidence report was published with an increase to 137.9 from the previous figure of 135.3 which was expected to be at 136.3 and S&P/CS Composite showed a decrease to 5.5% from the previous value of 5.9% which was expected to increase to 6.0%. On Friday the US Labor Department is due to release NFP reports. Among the components, Average Hourly Earnings report is expected to show a decrease to 0.2% from the previous value of 0.3%, Non-Farm Employment Change could have increased to 191k from the previous figure of 134k, and Unemployment Rate is expected to increase to 3.8% from the previous value of 3.7%. In this context, USD is currently quite indecisive which might lead to further corrections in the coming days.

On the CAD side, today BOC Governor Poloz is going to speak ahead of the GDP report which previously was at 0.2%. Today Poloz is expected to discuss rate hikes and future monetary policies that is expected to provide CAD with support in the coming days. Moreover, on Friday the economic calendar contains Canada's Employment Change, Unemployment Rate, and Trade Balance report. The previous reports revealed solid readings. Traders pin hopes on positive prints in the above-mentioned reports.

Meanwhile, CAD has been quite optimistic amid the recent economic data. USD is also catching up quite well. Ahead of US nonfarm payrolls, USD is expected to gain an advantage over CAD if the results come out better than expected. Otherwise, further volatility may lead to strong bearish counter leading to further CAD gains in the future.

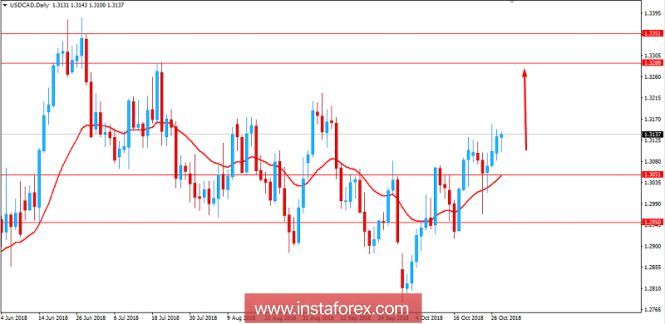

Now let us look at the technical view. The price is currently residing above 1.3050 area while also being above the dynamic level of 20 EMA. The price is expected to go higher towards 1.3300-50 area in the coming days. The price has been quite volatile with the recent price action. As the price cleared the recent lower high with a daily close, there is a better probability for further bullish momentum than bearish. As the price remains above 1.3050 with a daily close, the bullish bias is expected to continue.

SUPPORT: 1.2950, 1.3050

RESISTANCE: 1.3300-50

BIAS: BULLISH

MOMENTUM: VOLATILE