USD/CHF has been quite impressive with the recent bullish momentum which lead the price to reside above 0.9850 area with a daily close. The price dipped a bit lower this week due to worsethan-expected economic reports recently in the US which dented the overall gains of USD against CHF.

After the recent rate hike from 2.00% to 2.25%, USD gained impulsive momentum over CHF. However, USD lost steam after downbeat NFP readings. Today US CPI report was published with a decrease to 0.1% which was expected to be unchanged at 0.2% and Core CPI was unchanged at 0.1% which was expected to increase to 0.2%. Additionally, Unemployment Claims also increased to 214k which was expected to be unchanged at 207k.

On the CHF side, this week Unemployment Rate report was published with a decrease to 2.5% as expected from the previous value of 2.6%. The positive employment report pushed CHF lower as a retracement which may lead to certain short-term gains.

Meanwhile, ahead of Switzerland's PPI and Trade Balance reports to be published next week, any worse data from the US could empower CHF to sustain its momentum. Otherwise, any better than expected data from the US in the coming days may lead to continuation of the bullish trend.

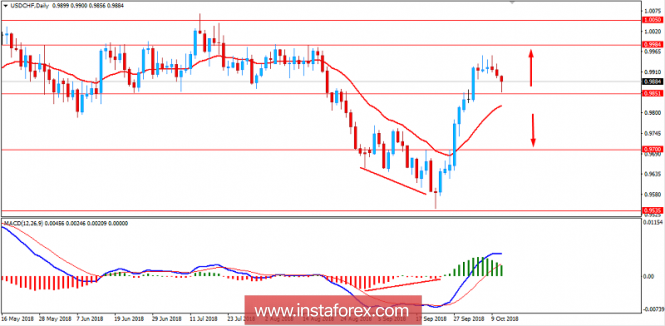

Now let us look at the technical view. The price has pushed a bit lower after certain corrections and volatility above 0.9850 area. The price is residing above the dynamic level of 20 EMA and the event area of 0.9850 that indicates further bullish momentum for the future. However, a daily close below 0.9850 may lead the price to proceed lower towards 0.9700 area in the future. As the price resides above 0.9850 area, the bullish bias is expected to continue with a target towards 1.00 area.

SUPPORT: 0.9700, 0.9850

RESISTANCE: 0.9980-1.00

BIAS: BULLISH

MOMENTUM: VOLATILE