To open long positions for GBP/USD, it is required:

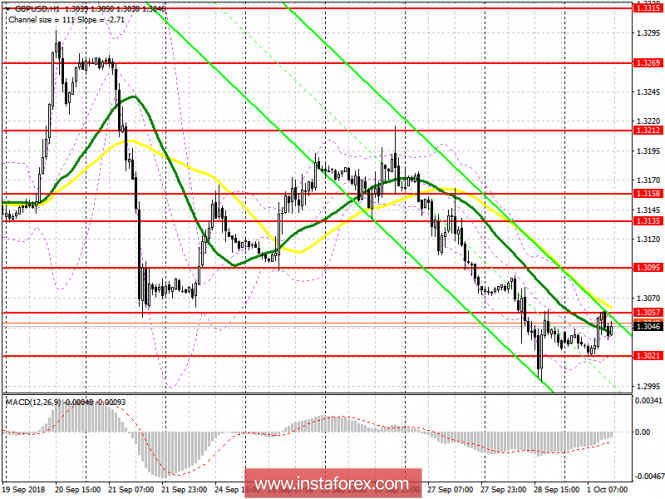

Buyers managed to keep the support level at 1.3021 and build a small upward correction from it, which led to an update of the resistance at 1.3057, which I paid attention to in my morning forecast. A retest of this level in the second half of the day can lead to a larger growth of the GBP/USD pair with a high of 1.3095, where I recommend to take profit. In the event of a decline in the pound to the support area of 1.3021, I do not recommend hurrying to open long positions from there. The best scenario for the purchase will be at least 1.2981.

To open short positions for GBP/USD, it is required:

Sellers have coped with the task of keeping the pair below the resistance of 1.3057, and while trading will be conducted under this range, we can expect a repeated decline in the pound to the support area of 1.3021, which will lead to a breakdown and a larger wave of the GBP/USD pair falling to a low in the area of 1.2981 and 1.2936, where I recommend locking in profits. In case of growth above 1.3057 in the second half of the day, it is best to return to short positions on the rebound from the resistance of 1.3095.

Indicator signals:

Moving Averages

The price returned to the 30-day moving average, which indicates the likelihood of a corrective growth of the pound in the short term.

Bollinger Bands

The volatility of the Bollinger Bands is falling against the background of the upward correction of the pound, which can play in favor of the sellers with the repeated test of support of 1.3021.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20