The unexpectedly strong US dollar and the unfavorable political landscape of Britain continue to push GBP / USD quotes towards the psychologically important mark of 1.3. The Fed's confidence in the need to raise the federal funds rate to 3.5% by the end of 2019 lent strength to the bears in the analyzed pair, and historical parallels about the Conservative Party congress do not allow the bulls to take advantage of positive macroeconomic statistics. In 2016, Theresa May's argument about hard Brexit accelerated the peak of the pound in the direction of the minimum since 1985, and doubts about the Prime Minister's ability to hold power sent the sterling to a monthly bottom in 2017.

After Theresa May at the Austrian EU summit, said that relations between London and Brussels were stalled, the currency of Albion was replaced. She also forgot about strong GDP for May-July, average wages, inflation, and retail sales. Yes, the timing of the increase in the repo rate has shifted from 2020 to autumn 2019, but as long as politics reigns, the economy is resting. Talk about the lack of agreement between Britain and the EU continues to bend the pound to the ground. According to the BMO Financial Group, GBP / USD will fall to 1.24 and to 1.2 within three and six months amid growing investor fears due to the lack of a deal.

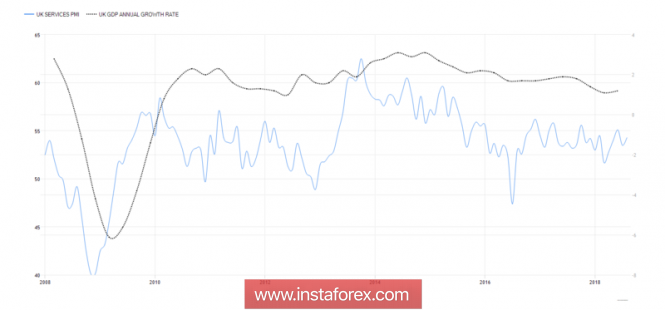

Additional pressure on sterling was put on the revision of GDP for the second quarter downward from 1.3% to 1.2% y / y, as well as a factor in the reduction of investments by British companies in April-June due to the uncertainty around Brexit. However, fans of the pound should not be disappointed about this, because, judging by GDP and retail sales, Misty Albion began the third quarter on a positive note. And if the data on business activity in the manufacturing sector and the service sector confirm this, the bulls on GBP / USD can get support. Nevertheless, the increased sensitivity of the sterling to the headlines of the media about Brexit suggests a temporary advantage from macroeconomic statistics.

The dynamics of business activity and GDP of Britain

Of course, the rising from the ashes of the US dollar plays a significant role in the peak of the analyzed pair. The derivatives market gives only a 5% chance of four Fed rate hikes in 2019. The indicator has room to grow, so it's premature to say that the factor of monetary restriction has already been included in the quotes related to the "American" currency pairs. At the same time, the indices of purchasing managers in the manufacturing sector of China approached the critical level of 50, which signals a serious slowdown in the economy of the Middle Kingdom under the influence of trade wars. The belief that this will not happen and China will be able to support the developing countries and the world economy as a whole, contributed to the withdrawal of the USD index from the August highs.

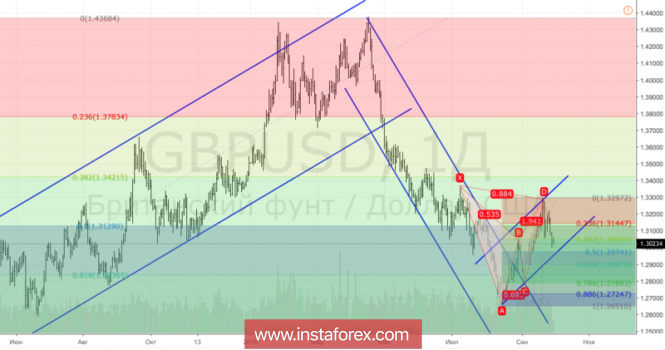

Technically, after reaching a target of 88.6% for the Bat pattern, a rollback occurs in the direction of 38.2% and 50% of the AD wave. If the bulls manage to keep the GBP / USD quotes within the ascending trading channel, their belief in restoring the long-term uptrend will not be lost.

GBP / USD, the daily graph