The European currency continues to decline in tandem with the US dollar after increasing disagreements between EU representatives and Italian authorities. Let me remind you that last week, a decision was taken by the Italian government, according to which the target budget deficit was raised to 2.4%, which is contrary to EU rules.

Canada signs deal with US and Mexico

Meanwhile, the Canadian dollar rose strongly against the US dollar after it became known at the weekend that Canada and the United States reached a trade agreement. Representatives of the US authorities said that the United States, Canada, and Mexico have agreed on an agreement that will replace the Nafta. The new version of Nafta will be called USMCA.

Thus, Canada's accession to the deal concluded between the US and Mexico at the end of August of this year avoided breaking the agreement and threats from the US President to introduce trade duties.

So far, the representative of the Minister of Foreign Affairs of Canada, Chrystia Freeland, has not provided any comments on the course of the negotiations. There are no specifics from the representatives of the White House administration.

As for the technical picture of the USD / CAD currency pair, a further decline in the trading instrument will be constrained by large support levels of 1.2770 and 1.2720, to which sellers are now striving. However, now, we can safely speak about the persistence of a strong uptrend of the Canadian dollar against the US dollar, which could be broken in the event of a breakdown of the agreement.

Basic data

Good data on US consumer spending growth supported the dollar on Friday afternoon. According to the US Department of Commerce, personal spending by consumers in August of this year rose by 0.3% compared with July.

Personal income also increased by 0.3%. Economists had forecast an increase in personal income in the United States in August by 0.4% and an increase in spending by 0.3%. A good increase in US consumer spending will have a positive impact on economic growth rates, which may exceed 4.0% in the 3rd quarter of this year.

Chicago business indicator fell in September due to a serious reduction in new orders and production. According to MNI Indicators, Chicago PMI Purchasing Managers Index in September of this year fell to 60.4 points from 63.3 points in August, while economists had expected that in September, the figure would be equal to 62.6 points.

The growth rate of orders fell to a minimum in the last five months, while production fell to a 6-month low. However, it should be recalled that the index values above 50 indicate an increase in activity.

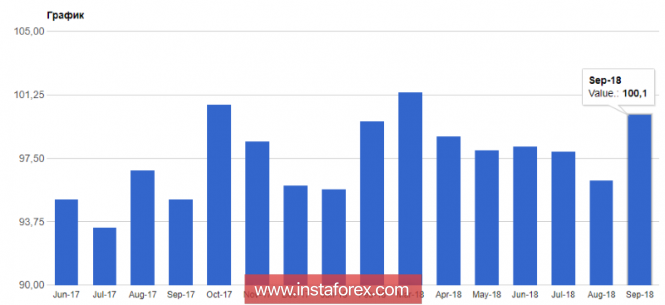

According to the University of Michigan, the final consumer sentiment index in the United States in September 2018 rose to 100.1 points from 96.2 points in August. Economists had expected the indicator to rise to 100.8 points.

The growth occurred against the background of a good economic performance of the country, as well as a healthy labor market, which makes consumers' confidence in a stable and even stronger future. The only concern was the problems with import duties.

Technical picture EUR / USD

The pressure on the euro, apparently, will slightly decrease, as the sellers need to build the upper limit of the downward channel, which, in my opinion, will take place in the resistance area of 1.1650. In this regard, in the absence of support from sellers after an attempt to break through this week's lows, it is best to return to short positions after correction from the highs of 1.1630 and 1.1650.

The material has been provided by InstaForex Company - www.instaforex.com