USD/CHF is currently quite volatile, corrective and indecisive while residing inside the range of 0.9980-1.0050 area with daily close. USD having better Employment reports recently managed to gain certain momentum over CHF but could not dominate it as expected in the process.

Ahead of the high impact event today including the FOMC Rate Statement and Federal Funds Rate which is expected to be unchanged at 2.25%, USD is pressurizing CHF quite impulsively which is expected to lead to certain momentum in the process. Ahead of the PPI report tomorrow which is expected to be unchanged at 0.2%, market sentiment is currently quite indecisive with the USD gains in the coming days.

On the CHF side, the increase in Foreign Currency Reserves to 753B from the previous figure of 740B and Unemployment Rate remaining unchanged at 2.5% ahead of Government Board Member Maechler's speech today provide the required optimism for the currency in the process. Though CHF has been dominated by USD for a certain period earlier but currently USD is struggling to maintain the impulsiveness in the process.

To sum up, USD having certain dominating pressure over CHF for the past few weeks may come to an end if the FOMC Rate Statement creates dovish vibe for the current market sentiment which will lead to counter bearish momentum for the coming days.

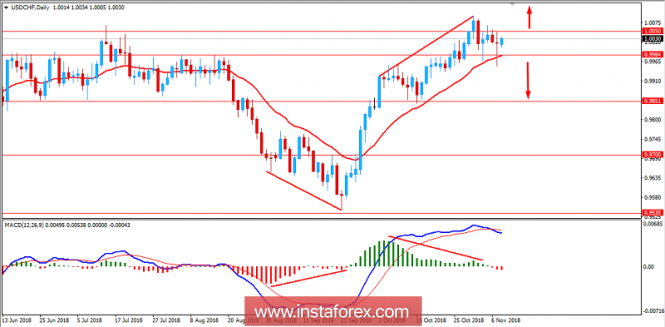

Now let us look at the technical view. The price is currently residing inside the range between 0.9980-1.0050 area from where a daily close below or above the range is expected to lead to upcoming price actions in the pair. Though there are certain chances of bearish counter which will be only confirmed after a daily close below 0.9980 is observed or else as per trend, a bullish breakout is expected to lead to further bullish momentum in the coming days. As the price remains above 0.9980 area, the bullish bias is expected to continue.

SUPPORT: 0.9850, 0.9980

RESISTANCE: 1.0050

BIAS: BULLISH

MOMENTUM: VOLATILE