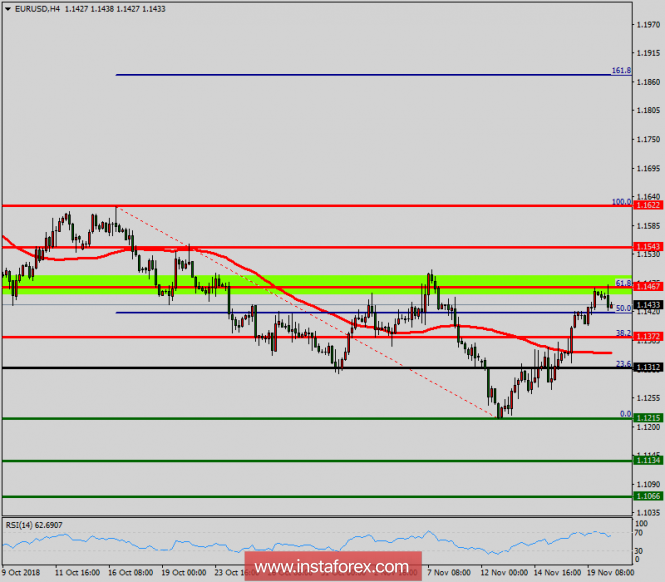

The EUR/USD pair fell from the level of 1.1467 to the bottom around 1.1215. But the pair rebounded from the bottom of 1.1215 to close at 1.1347. Probably; historic will repeats itself again. Today, the first support level is seen at 1.1215, and the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.1312, which coincides with the 23.6% Fibonacci retracement level. This resistance has been rejected several times confirming the downtrend. Additionally, the RSI starts signaling a downward trend. As a result, if the EUR/USD pair is able to break out the first support at 1.1215 , the market will decline further to 1.1134 in order to test the weekly support 2. In the H4 time frame, the pair will probably go down because the downtrend is still strong. Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 1.1215 with the first target at 1.1170 and further to 1.1134. At the same time, the breakdown of 1.1312 will allow the pair to go further up to the levels of 1.1467 in order to retest the major resistance.

The material has been provided by InstaForex Company - www.instaforex.com