GBP/USD has been quite volatile and corrective while pushing lower gradually towards 1.2700 area with a daily close. GBP has been weighed down by the Brexit nerves. Despite upbeat economic reports from the UK, GBP is struggling to gain momentum over USD ahead of NFP and the highly probable rate hike in the coming days.

The Brexit deal has been in the limelight for a few weeks now that pushed GBP lower. GBP suffered a blow after a resignation of the Brexit minister. Bank of England's Governor Carney recently warned that Brexit would cause greater damage to the UK economy than to the EU economy. He also stated that Britain is still not 100% ready for trading according to World Trade Organization's rules which might have immediate impact on the economy after Brexit. Additionally, Parliament has rejected Prime Minister May's proposal as she lost votes recently which might lead to PLAN B of the Brexit deal, leading to certain changes in the main terms. Today Services PMI report is going to be published which is expected to have a slight increase to 52.5 from the previous figure of 52.2. Besides, FPC Meeting Minutes are going to be published where in-depth financial conditions in the UK and a further decision on Financial Stability are going to be discussed that is expected to havea slight impact on the overall UK economy at the current stage.

On the USD side, ahead of NFP and a probable rate hike this month, the economic reports have been quite mixed that encouraged gains on the USD side, sustaining the overall bearish momentum despite sudden spikes in the market. Today FOMC Member Brainard is going to speak about the key interest rate decision and future monetary policy. The speech is expected to contribute to further gains of USD. Though the NFP reports are expected to show mixed results, any positive outcome may lead to more impulsiveness on the USD side in the future.

Meanwhile, GBP is expected to struggle further to regain its momentum over USD. Any positive reading of the US economic reports and events may lead to further bearish pressure in the pair with greater sustainability and non-volatile bearish trend in the future.

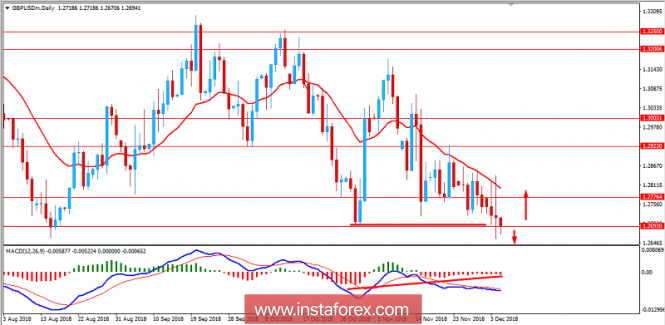

Now let us look at the technical view. The price has been quite volatile but bearish with the recent momentum which lead the price to reside at the edge of 1.2700 area with a daily close. Recently the price has formed Bullish Divergence which might propmt the price to push higher towards 1.2930-1.3000 resistance area in the coming days or else a daily close below 1.2700 is expected to push the price much lower towards 1.2500 area in the future. As the price remains below 1.30 area, the bearish bias is expected to continue.

SUPPORT: 1.2500-50, 1.2700

RESISTANCE: 1.2780, 1.2930, 1.30

BIAS: BEARISH

MOMENTUM: VOLATILE