NZD/USD is currently quite impulsive with the bearish pressure, breaking below the 0.6850 area. Amid the recent economic reports and fundamental events, USD has managed to gain momentum over NZD, and this gain is expected to continue further.

New Zealand has been trying to improve its current banking system. RBNZ being stubborn about the interest rate and monetary policy decisions is assumed as the leading factor for sudden weakness of NZD. Recently, New Zealand FPI report has been published unchanged at -0.6% and today, Business NZ Manufacturing Index report has been released with a decrease to 53.5 from the previous figure of 53.7. The worse economic result caused NZD to lose grounds, pushing it much lower.

On the other hand, USD has been recently struggling to gain momentum over NZD amid the economic results and indecision of Federal Funds Rate Hike which confused the market sentiment for the upcoming momentum of the currency in the market. The risk of the US recession in the next two years has risen to 40% against the background of the sudden change in the interest rate hike decision for 2019. Recently, US Import Prices report has been published with a decrease to -1.6% from the previous value of 0.5% which was expected to be at -1.0%. Besides, Unemployment Claims has been released with a positive result with a decrease to 206k from the previous figure of 233k which was expected to be at 226k. Today, US Core Retail Sales is expected to decline to 0.2% from the previous value of 0.7%; and Retail Sales Index is expected to be down to 0.1% from the previous value of 0.8%. Moreover, Industrial Production is expected to increase to 0.3% from the previous value of 0.1%; and Business Inventories is also estimated to grow to 0.6% from the previous value of 0.3%.

Under the current scenario, USD is expected to sustain the bearish momentum in the pair while NZD is losing grounds due to worse economic results. Nevertheless, there is a chance that NZD will gain back momentum next week, since ANZ Business Confidence report is going to be published with a positive result in the market.

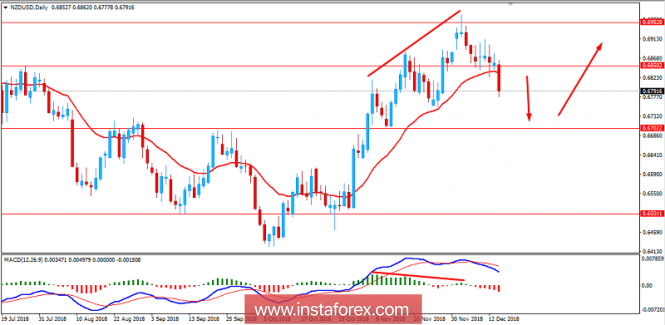

Now let us look from a technical perspective. After the previous formation of Bearish Divergence, the price is currently residing below the area of 0.6850 with a strong bearish pressure which is expected to close with a daily candle below the area as well. The price has recently pierced below the dynamic level of 20 EMA which indicates further bearish pressure in the coming days. As the price remains below the area of 0.6850 with a daily close, it is expected to push towards the 0.6700 area from where certain bullish pressure is expected in the future.

SUPPORT: 0.6500, 0.6700

RESISTANCE: 0.6850, 0.6950, 0.70

BIAS: BULLISH

MOMENTUM: VOLATILE