USD/CAD has been non-volatile and impulsive amid the bullish pressure, leading the price above 1.3350 with a daily close. Ahead of a widely expected rate hike by the Federal Reserve, Powell's speech, and NFP this week, USD has been dominating CAD consistently which may lead to certain bearish intervention in the coming days.

Despite some headwinds, USD managed to sustain the impulsive bullish momentum over CAD which was quite remarkable despite the recent mixed US economic data and softer rhetoric of the Federal Reserve. Analysts predict weak nonfarm payrolls. Today Revised Non-Farm Productivity report is going to be published which is expected to increase to 2.3% from the previous value of 2.2%, Revised Unit Labor Cost is expected to decrease to 1.1% from the previous value of 1.2%, Trade Balance could have decreased to -55.2B from the previous figure of-54.0B, Unemployment Claims are expected to contract to 226k from the previous figure of 234k, and ISM Non-Manufacturing PMI is expected to decrease to 59.1 from the previous figure of 60.3. Moreover, FOMC Member Bostic is going to speak today about the upcoming interest rate and monetary policy rhetoric. His speech could contribute to further USD gains.

On the other hand, the Bank of Canada left the target overnight rate unchanged at 1.75%. The Policy Statement indicated a minor slowdown in the economic growth which is acknowledged to be stable and consistent. Today Bank of Canada's Governor Poloz is going to speak about the short-term interest rate decisions and future monetary policies that is expected to inject volatility. Moreover, tomorrow Canada's Employment Change is expected to decrease to 10.3k from the previous figure of 11.2k and Unemployment Rate is expected to be unchanged at 5.8%.

Meantime, the pair is set to trade with higher volatility ahead of macroeconomic reports from the US and Canada which are due later this week. Bearish intervention is not ruled out. Though USD has been the dominant currency in the pair, certain pullbacks may be observed if CAD performs better than expected on the back of the economic reports as well as a hawkish statement from Poloz today.

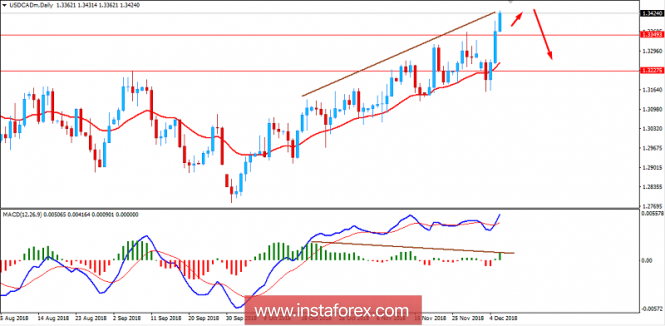

Now let us look at the technical view. The price is currently residing above 1.3400 area leading the price towards 1.3500 resistance area from where it is expected to push lower towards 1.3220-1.3350 area in the coming days. Though the price is still quite impulsive with the bullish pressure, Bearish Divergence emerging in the price structure for a long period of time may come as a strong counter-move. As the price remains below 1.3500 area, certain pullback towards 1.3220-1.3350 support area is expected in the coming days before it continues with the bullish trend again.

SUPPORT: 1.3220, 1.3350

RESISTANCE: 1.3500

BIAS: BULLISH

MOMENTUM: NON-VOLATILE and IMPULSIVE