USD/JPY has been quite impulsive with the recent bearish momentum in the pair while residing between the price range of 111.50 to 114.50 area. Ahead of the federal funds rate decision, the FOMC Statement and the BOJ Policy Rate to be published this week, USD is expected to regain impulsive momentum against JPY in the current market scenario.

The weakness of USD ahead of high impact economic events and report indicates certain impulsive momentum in the process. This week the Federal Reserve is going to be announce its interest rate decision. The funds rate is expected to increase to 2.50% from the previous value of 2.25%. Though the Fed is still quite optimistic with the upcoming rate hike which is quite imminent, President Trump is opposing this rate hike cycle as he thinks it could cause great economic depression in the coming years. The Fed has recently declared that a rate hike can be delayed in 2019 but it will fulfill its target. Today the US building permits report is going to be published with an increase to 1.27M from the previous figure of 1.26M and the housing starts is expected to be unchanged at 1.23M.

On the JPY side, recently Japan's government has revised down its forecast for economic growth and consumer prices for the current and next fiscal year as weakening export demand and natural disasters weighted on the economy. Japan's economy is expected to grow by 0.9% in the fiscal year of 2018 which was expected to be at 1.5% earlier. Ahead of the BOJ Policy Rate report to be published with an unchanged value of -0.10% and the All Industry Activity to increase to 2.0% from the previous negative value of -0.9%, tomorrow Japan's trade balance report will see the light which is expected to decrease to -0.31T from the previous value of -0.30T.

As of the current scenario, USD is quite optimistic with the upcoming economic events and reports which is expected to provide immediate gains for the currency in the coming days whereas JPY is still struggling with the current economic results and the upcoming economic expectations.

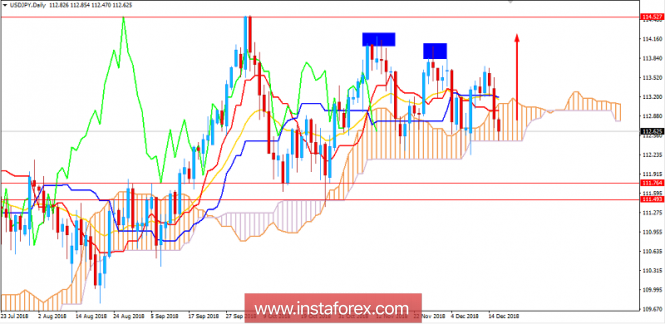

Now let us look at the technical view. The price is currently residing at the edge of the dynamic support of Kumo Cloud as well as the 112.50 support area from where it is expected to push higher towards 114.50 in the coming days. As for the preceding trend, the price has more chances for pushing higher whereas a break with a daily close below 111.50 is expected to lead the price much lower in the coming days. As the price remains above 111.50 with a daily close, the bullish bias is expected to continue.

SUPPORT: 111.50, 112.00-50

RESISTANCE: 114.00-50, 115.00

BIAS: BULLISH

MOMENTUM: VOLATILE