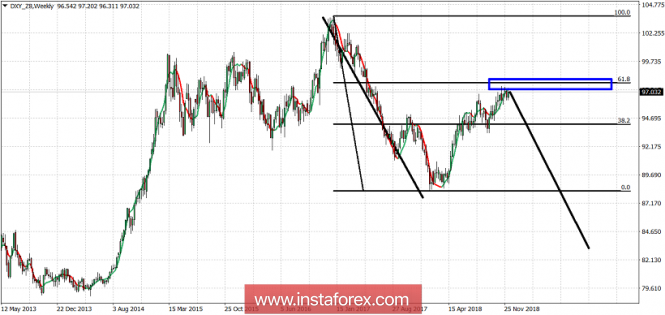

The Dollar index has reached a very important Fibonacci resistance. A rejection at this area will increase the chances of the bearish scenario for at least one more strong leg lower and heavy selling for the Dollar.

Black lines - expected path

The Dollar index has bounced towards the 61.8% Fibonacci retracement resistance. This is a very important resistance level and possible reversal area. This counter trend rally in the index could soon be over. I believe it is more probable to see a full scale reversal and rejection around 97 and the start of the next leg lower towards 87. It is still too early though and traders should keep in mind of this possible scenario. Either way it is confirmed that the resistance is important at current levels and buying here is very risky.

The material has been provided by InstaForex Company - www.instaforex.com