EUR/JPY has been quite volatile and impulsive with the recent bearish momentum. The price bounced off the 119.00 area recently and is currently hovering at the edge of 125.00 area. JPY is backed by strong fundamentals while EUR is struggling for gains. This may lead to further bearish momentum despite the recent bullish pressure amid several positive economic reports from the euro area.

EUR is facing some headwinds, including BREXIT. EUR is currently quite weak fundamentally. So, EUR is expected to extend weakness. Recently German Retail Sales report showed an increase to 1.4% from the previous value of 0.1% that helped EUR to gain certain momentum but it did not invite the bulls as expected. Besides, German Industrial Production contracted to -1.9% from the previous value of -0.8% and French Trade Balance also decreased to -5.1B from the previous figure of -4.1B. As a result, EURO lost the constant pressure it created along the way. Today German Trade Balance report is going to be published which is expected to increase to 17.9B from the previous figure of 17.3B, Italian Monthly Unemployment Rate is expected to decline to 10.5% from the previous value of 10.6%, and the eurozone's Unemployment Rate is expected to be unchanged at 8.1%. Ahead of ECB Monetary Policy Meeting Accounts, EUR is expected to remain a bit indecisive and volatile with the upcoming price action.

On the other hand, JPY has found support from the recently published economic reports but today. Japan's Average Cash Earnings report was published with an increase to 2.0% from the previous value of 1.5% which was expected to decrease to 1.3%. The positive economic result managed to create a barrier for further gains on the EUR's side and opened the door for upcoming bearish pressure in the pair if pending reports from Japan perform better than expected.

Meanwhile, despite the recent EUR's gains, JPY is expected to regain its momentum and continue with the trend amid the positive economic data and upcoming optimistic expectations of the economic reports.

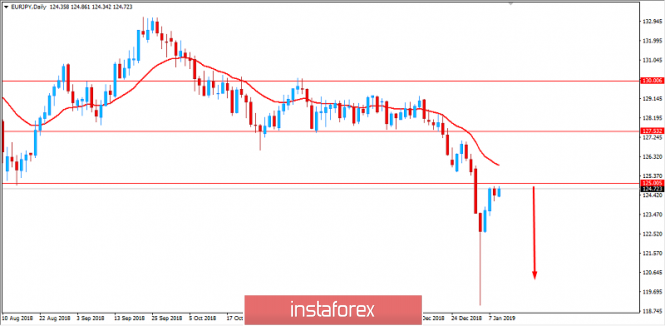

Now let us look at the technical view. The price is currently residing at the edge of 125.00 event area from where it is expected to dip lower towards 120.00 support area in the coming days. The dynamic level of 20 EMA with a downward slope and ability to hold as resistance is expected to lead to further bearish pressure as well. As the price remains below 125.00 area with a daily close, the bearish bias is expected to continue further.

SUPPORT: 120.00, 122.50

RESISTANCE: 125.00, 126.50

BIAS: BEARISH

MOMENTUM: VOLATILE