GBP/USD has been trading with higher volatility with extreme price swings since the Parliamentary Brexit Vote yesterday. After the defeat of British PM Theresa May's Brexit Divorce deal, the market turned volatile without a clear trend as the political chaos could be triggered in the coming days.

Ahead of the Brexit deadline on March 29, the UK is facing the deepest political crisis which has not been observed for the last 50 years. PM May disagrees with the vote and states that the vote does not tell about what exactly the House of Commons supports. So, there is still a dilemma about the overall decision. Meanwhile, GBP has lost favor with investors today. Citing well-informed sources, experts believe there is a strong liklihood that the Britons will insist on the second vote in a national ballot. As things are currently quite different from that of 2016, the Brexit deal is going to make a severe impact on GBP. Currently the Brexit deal is facing two scenarios. It could get delayed which will end up with certain positive outcome. Alternatively, immediate higher volatility may lead to severe weakness of GBP and in the long run it is going to extend softness. Today Bank of England Governor Carney is going to speak about monetary policy. His speech is expected to hold a key to further price development of GBP. Things are still quite indefinite, and GBP is going to trade firmly lower.

On the other hand, FED's Presidents of different states advocate for a pause in monetary tightening to observe the impact fo such a pause on the economy. Too rapid pace of rate hikes may create uncomfortable conditions for developing businesses in the country. US President Donald Trump has targeted the cycle of rate hikes. But the FED did not respond to it and took a paternalistic approach to the recent rate hikes. The FED has raised interest rate 9 times since 2015, including 4 times in 2018. FED's Dallas President Kaplan stated that some industries are being affected already by the rate hikes, which tightened financial conditions and slowed down global growth. Recently US PPI report was published with a decrease to -0.2% from the previous value of 0.1% which was expected to be at -0.1% and Core PPI also showed decrease to -0.1% from the previous value of 0.3% which was expected to be at 0.2%.

Meanwhile, ahead of UK CPI, RPI, and PPI reports to be published today which could be downbeat, the pair could make corrections amid higher volatility. USD has been affected by worse-than-expected economic reports. Though GBP may look weaker than USD in comparison, the pair is going to trade without a clear trend which will be evident in the coming days.

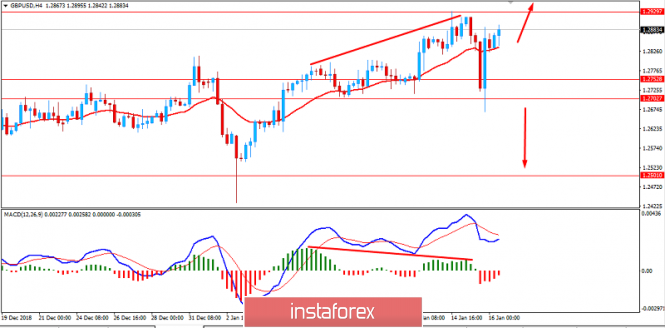

Now let us look at the technical view. The price is currently residing below 1.30 area with a daily close while having extreme volatility in place. Though the price recently rejected off the 1.2700-50 support area with a daily close. The overall bias is bullish. As the price breaks below 1.2700 area with a daily close, the trend is going to face a counter-move with strong bearish momentum. As the price remains above 1.27 with a daily close, the bullish bias is expected to continue.

SUPPORT: 1.2500, 1.2700-50

RESISTANCE: 1.2930, 1.30

BIAS: BULLISH

MOMENTUM: VOLATILE