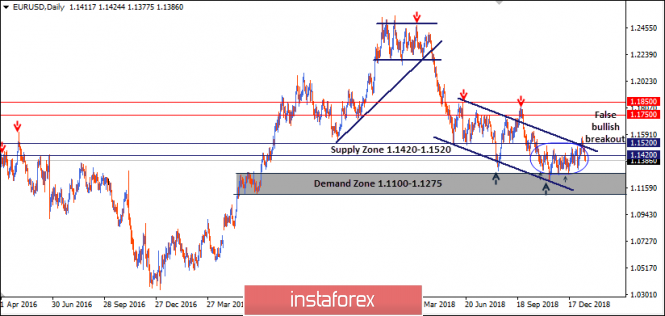

Since June 2018, the EUR/USD pair has been moving sideways with a slight bearish tendency. Narrow sideway consolidations have been maintained within the depicted daily movement channel.

On November 13, the EUR/USD pair demonstrated recent bullish recovery around 1.1220-1.1250 where the lower border of the channel as well as the depicted demand zone came to meet the pair.

Bullish fixation above 1.1420 was needed to enhance further bullish movement towards 1.1520. However, the market demonstrated significant bearish rejection around 1.1420 a few times.

Last week, a recent attempt of a bullish breakout above 1.1520 (upper border of the depicted movement channel) was executed. However, early signs of a bearish rejection are being expressed below 1.1520 and 1.1420 on the daily charts.

This renders the recent bullish breakout above 1.1420 and 1.1520 as a false breakout. Hence, any bullish pullback towards 1.1420 can be considered as a valid SELL entry for intraday traders.

The current bearish decline below the key level of 1.1400 brings more sideway downward consolidations to 1.1250 again where bullish rejection may be anticipated for a valid BUY entry.

On the other hand, in case a successful bullish breakout above 1.1520 is achieved again, this enables further bullish advancement towards 1.1600 (October's High) and probably 1.1720 if enough bullish momentum is maintained.

The material has been provided by InstaForex Company - www.instaforex.com