USD/CAD has been quite volatile between the price range of 1.3200 to 1.3350, from where it is currently moving lower with strong bearish momentum. USD failed to gain momentum over CAD despite the positive economic reports and hawkish FED statement recently that indicates indecision in the market.

Recently FED Chairman Powell has been quite optimistic in his recent speech as he spoke about the strong US economy and unemployment dropping to nearly a 50-year low. Analysts speculate on the likelihood of recession. However, Jerome Powell disagreed with it completely and denied the scenario of recession. Kansas City FED President Esther George recently stated that a pause in rate hikes is required for assessing the decision made earlier. Meanwhile, the domestic economy has been showing strong performance. Recently US JOLTS Job Opening report was published with an increase to 7.34M from the previous figure of 7.17M which was expected to decrease to 6.84M. Today US CPI report is going to be published which is expected to increase to 0.1% from the previous value of -0.1% and Core CPI is expected to be unchanged at 0.2%. Moreover, US lawmakers managed to come to a deal on President Trump's demands for funding the protective wall along the US-Mexico border. The US dollar perked up amid the welcome news.

On the other hand, as a commodity currency the loonie gained momentum amid the oil's steady rally. The Canadian Labor Market showed significant growth to 66.8k from the previous value of 9.3k which was expected to decrease to 6.5k which empowered CAD to gain momentum despite the healthy US economy. The Bank of Canada is not currently expected to increase the rates soon. Unstable oil prices are likely to affect the overall CAD gains. Tomorrow Canada's Manufacturing Sales report is going to be published which is expected to increase to 0.3% from the previous value of -1.4% and NHPI is expected to be unchanged at 0.0%.

Meantime, the US economy remains on a sound footing, while Canada's economic growth is expected to slow down.

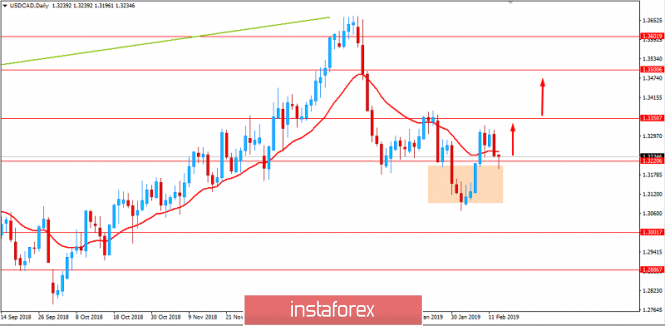

Now let us look at the technical view. The price is currently trading above 1.3200 with a retest after, following impulsive bearish pressure. After the recent false break below 1.3200 area, the bulls are currently quite active at 1.3200 from where certain bullish pressure is expected which may lead the price towards 1.3350 and later towards 1.3500 area in the coming days. As the price remains above 1.3200 area with a daily close, the bullish bias is expected to continue.

SUPPORT: 1.30, 1.3200

RESISTANCE: 1.3350, 1.3500

BIAS: BULLISH

MOMENTUM: VOLATILE