CHF has been holding the upper hand over USD recently after positive economic reports from Switzerland which managed to attract market sentiment.

Recently Switzerland's Trade Balance report was published with an increase to 3.04B from the previous figure of 1.96B which was expected to be at 2.24B. Thanks to a larger trade proficit, CHF reinforced momentum against USD while it is struggling with worse economic reports and attracting criticism for Balance Sheet shift. Credit Suisse Economic Expectations report is due next week, which has been ranging between -44.0 and -14.3 area, any positive reading is expected to enhance CHF gains in the coming days.

Recently the US FED unveiled a shift in stance on the balance sheet that aroused criticism from some media sources. The Federal Reserve is currently thinking of stopping the unwind of $4 trillion balance sheet later this year that is strongly disliked by market watchers as they think it will be a terrible mistake. According to the FED, balance sheet reduction is going on for a year and it has not made a significant impact on the economy and financial markets yet, though the economy is expected to benefit from normalization of the balance sheet. Additionally, JP Morgan recently downgraded US Q1 GDP growth outlook to 1.5% from the previous forecast of 1.75%. There are several reasons, but the dongraded forecast is clearly leading the market to indecision and volatility.

Recently US Core Durable Goods Orders report was published with a minor increase to 0.1% from the previous value of -0.4% but it failed to meet the expected value of 0.3% and Philly FED Manufacturing Index was published with a decrease to -4.1 from the previous figure of 17.0 which was expected to be at 14.1. Another market moving event today is FED's Monetary Policy report. Besides, FOMC Members Williams and Clarida are due to speak later in the global trading day. These events are likely to inject volatility in the market.

Meanwhile, USD is extending weakness on the back of downbeat economic data and bearsih market sentiment. Thus, CHF is taking advantage of USD weakness to assert its strength.

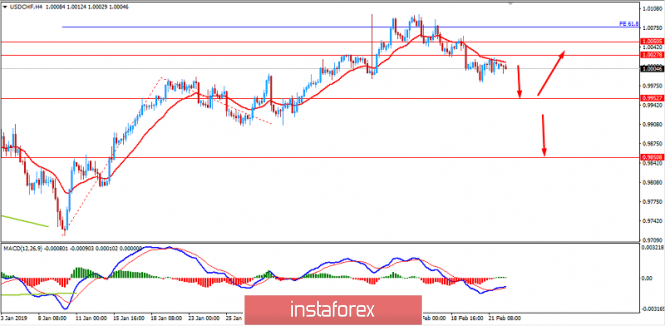

Now let us look at the technical view. The price is currently trading below 1.0025 to 1.0050 resistance area while also being held by the dynamic level of 20 EMA as resistance. As the price continues to trade below 1.0050 with a daily close, further bearish pressure with a target towards 0.9950 and later towards 0.9850 is expected in the future.