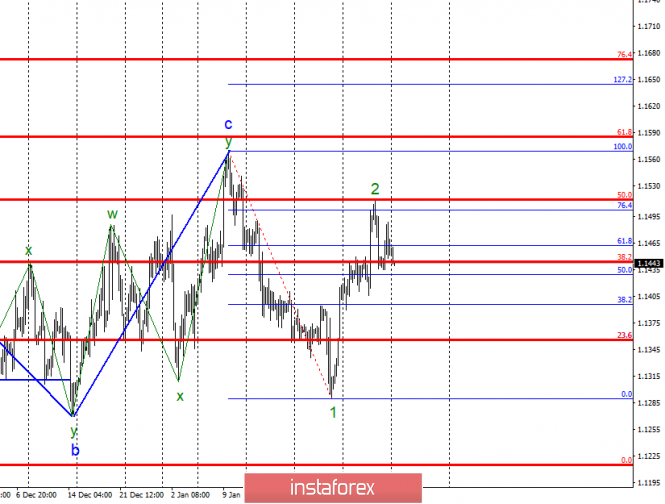

Wave counting analysis:

The trading on Friday, February 1, ended with a 10 bp rise for the EUR / USD pair. Since the maximum of January 31 was not broken, wave 2 is considered to be completed, and I expect the quotes to continue to decline as part of the future wave 3 of the downward trend segment with targets around 13 figures. Still, an alternative option is to build a downward wave but within a three-wave downward structure. The decline below figure 13 level causes some doubts, since this area will be very difficult to pass and you will need a news background, which is a dollar.

Sales targets:

1,1289 - 0.0% Fibonacci

1.1215 - 0.0% Fibonacci

Shopping goals:

1.1502 - 76.4% Fibonacci

1.1569 - 100.0% Fibonacci

General conclusions and trading recommendations:

The pair supposedly completed the construction of the correctional wave 2. Thus, now I recommend selling the instrument with targets located near the marks of 1.1289 and 1.1215, which equates to 0.0% and 0.0% Fibonacci. A successful attempt to break through the level of 50.0% on the older Fibonacci grid will push the conclusion that the instrument is ready for an increase and will require making adjustments to the markup.

The material has been provided by InstaForex Company - www.instaforex.com