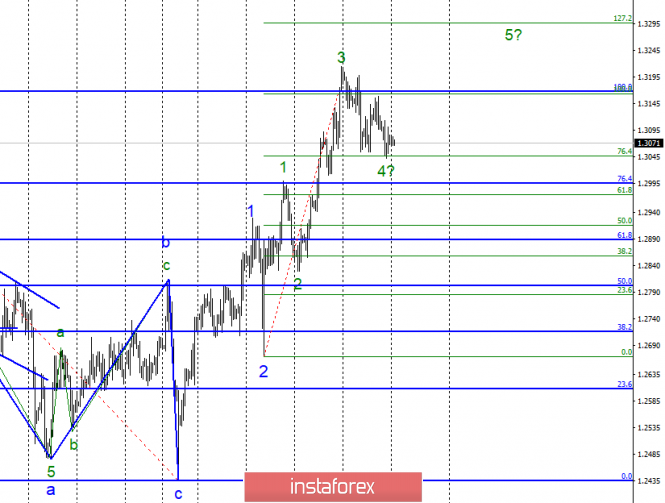

Wave counting analysis:

On February 1, the GBP / USD pair lost several dozen base points, which led to an update of the previous local minimum, and that was considered at least wave 4. The fact that the attempt to break through the Fibonacci level of 76.4% was unsuccessful leaves a little hope for the resumption of the up link plot trend within wave 5, in 3 with targets located near the level of 127.2% on the younger Fibonacci grid. At the same time, a breakthrough of the level of 1.3046 will most likely lead to the need to clarify the current wave pattern.

Shopping goals:

1,3297 - 127.2% Fibonacci

1.3367 - 127.2% Fibonacci

Sales targets:

1.2996 - 76.4% Fibonacci

1.2889 - 61.8% Fibonacci

General conclusions and trading recommendations:

The wave pattern assumes the construction of an upward wave of 5: 3. Thus, I expect the resumption of the increase and recommend buying the instrument with targets that are near the estimated level of 1.3297, which equals 127.2% Fibonacci. A successful attempt at a breakthrough of 1.3046 will cancel the execution of this option, and all wave marking will require new ideas.

The material has been provided by InstaForex Company - www.instaforex.com