Yesterday, the market actively acted out rumors that were already presented by the end of March. China and the United States would be able to sign a new trade agreement. This news was accompanied by reports of the White House's readiness to abolish duties on a number of goods from the Middle Kingdom. Investors want to believe that if the two largest economies of the world resolve their trade disputes, it will provide new energy into the world economy. And thus, it will begin to grow more actively. That is, not only that we are hoping for the best on the growth for the dollar, but also these expectations themselves are based on erroneous judgments. The slowdown of the world economy is caused not by trade wars, but by structural and systemic problems of the world economy. In fact, trade wars are their consequence, and not vice versa. And the United States, represented by Donald Trump, is only trying to patch holes with the help of a review of trading conditions. However, no one is going to solve the problem itself. It is not even considered acceptable to discuss about real problems. After all, there are studies that show catastrophic increase in the gap between the rich and the poor, especially in the richest and most developed countries where it goes beyond the academic environment. We prefer not to talk about this problem because it might lead to mass agitation and misinformation.

To some extent, the market has already won back the news about a possible agreement between Washington and Beijing. Now, they will be more attentive to follow other news. Today comes a good number of macroeconomic indicators. In Europe, there are summary data on the index of business activity in the services sector, as well as a composite index. These data should confirm the growth of the business activity index in the services sector from 51.2 to 52.3, and the composite index from 51.0 to 51.4. But, this is only confirmation of preliminary data, which does not have a strong impact on the market. However, the growth rate of retail sales should accelerate from 0.8% to 1.2%. The European statistics will clearly support the single European currency. Expectations in the UK are not so optimistic, as the business activity index in the service sector may fall from 50, 1 to 49.9. However, the US statistics will contribute to the weakening of the dollar because sales of new homes should fall by 9.1%. On the other hand, the final data on business activity indices should confirm a preliminary assessment, which showed an increase in the business activity index in the services sector from 54.2 to 56.2, and the composite index from 54.4 to 55.8.

The euro / dollar currency pair, similar to its fellow pound / dollar, continued to form a correction, upon reaching a range of 1.1300 / 1.1320 as a result. We should probably assume a stagnation, followed by a rollback towards 1.1350-1.1375.

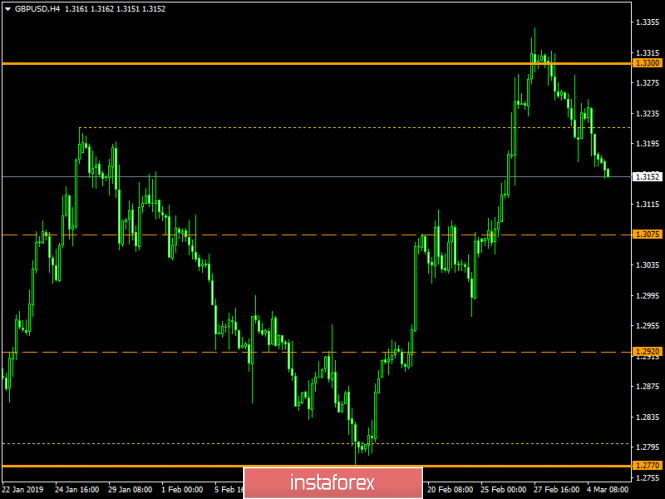

The currency pair pound / dollar continued the formation of the corrective movement, moving closer to the Fibo-level of 38.2 in the area of 1.3140. It is likely to assume that the recovery process is approaching, where a rather realistic rebound in the direction of 1.3200 seems to be found.