Australia presented mixed economic reports which prive that its economy is still missing momentum. Amid weaker fundamentals, AUD is set to lose ground versus USD in the coming days.

Recently, Australia's Retail Sales report was published with a decrease to 0.3% from the previous value of 0.9%, beating the forecast for a 0.2% gain. Trade Balance proficit decreased to 4.95B from the previous figure of 5.14B but it also surpassed expectations for a 4.49B proficit. Moreover, AUD leapt as the Reserve Bank of Australia kept its key Official Cash Rate at its record low of 1.50%, destroying expectations of a further cut. Rate-futures markets were aggressively pricing in a rate cut thanks to protracted feeble inflation. The RBA acknowledged this but also highlighted strength in the labor market which, it feels, may yet take up the remaining economic slack and boost pricing power. the RBA Board recognized that there was still spare capacity in the economy and that a further improvement in the labor market would be needed for inflation to be consistent with the target.

On the other hand, today Fed's Chairman Powell is going to speak about the upcoming monetary policy decision which is expected to be neutral but optimistic for ongoing economic developments. Additionally, US PPI report is going to be published which is expected to decrease to 0.2% from the previous value of 0.6%. US Trade Balance deficit could have widnened to -51.4B from the previous figure of -49.4B. Unemployment Claims are expected to drop to 215k from the previous figure of 230k.

Moreover, disappointed with slow progress in the US-China trade talks, Donald Trump accused China for giving up some of its earlier commitments and threatened to raise tariffs on Chinese imports. The market sentiment on USD is sensitive to negative twists in the trade talks. So, USD has not been as impulsive as expected due to such developments. On the plus side, the US confirmed a better-than-expected unemployment rate and accelerating inflation that sognals low recession risk.

To sum it up, ahead of RBA Monetary Policy Statement tomorrow, AUD is expected to be quite volatile with the gains. Besides, Fed's Chair Powel today will clear up market sentiment on USD. Probably, the policymaker will convince traders to buy USD.

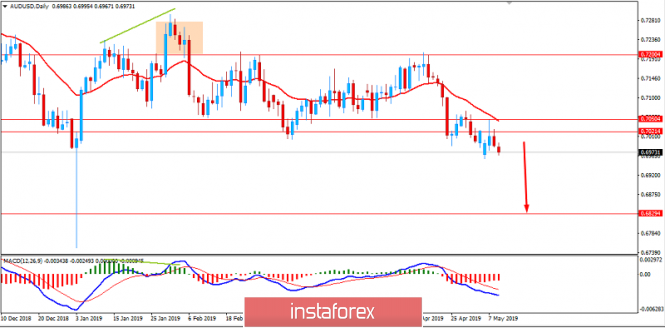

Now let us look at the technical view. After breaking below 0.70 area with a daily close, the price has recently retested it with a daily candle while closing below with pressing bearish momentum. The price is currently going lower after the retest. AUD/USD is expected to continue its downward momentum with a target towards 0.6850 support area in the coming days. As the price remains below 0.70 area with a daily close, the bearish bias is expected to continue.