USD/CAD has been quite volatile with the recent price action above 1.3400 area. Previously, an impulsive break above this level was seen at a daily close. The Federal Reserve has taken a dovish stance, keeping the rates unchanged. It is expected to lead to further weakness of USD against CAD in the coming days.

At its latest monetary policy meeting, the FOMC left the funds rate unchanged at 2.50%. There had been some expectations regarding the Fed's intentions to shift towards a rate cut. The focus is still on the fact that the inflation rate is below the Fed's target which suggests that the central bank is reluctant to make any dramatic changes in the coming months.

The non-farm employment change report which is expected to show a decrease 181k from the previous figure of 196k. At the same time, the average hourly earnings report is expected to increase to 0.3% from the previous value of 0.1% and the unemployment rate is expected to be unchanged at 3.8%. Amid a deluge of economic data, the US dollar will come under the spotlight. On the back of the upbeat GDP report, the American currency has all the chances to extend gains.

On the other hand, Canada's central bank also left the interest rate unchanged at 1.75%. Nonetheless, CAD managed to gain momentum against USD due to the recent dovish statements of the Fed. The Bank of Canada provided rather feeble outlook for the economic growth, so it would be surprising if the actual results undershoot the estimates. The is a 50% chance that the BOC will decide on an interest rate cut this year, but this kind of tepid growth projection has raised the bar for policy easing. The Canadian GDP forecast for the year was decreased to 1.2% from the previous estimate of 1.7%.

Remarkably, the Bank of Canada is monitoring the economic developments, especially in household spending, the oil market and global trade. BOC Governor Stephen Poloz is still quite optimistic and sees developing economy, expecting a rate hike if the consistency is ensured in the future.

As of the current scenario, USD can be highly volatile ahead of high-impact economic reports and amid the Fed's dovish sentiment observed recently. On the other hand, if CAD fails to gain ground against USD according to the current scenario, then USD is expected to advance in the coming days.

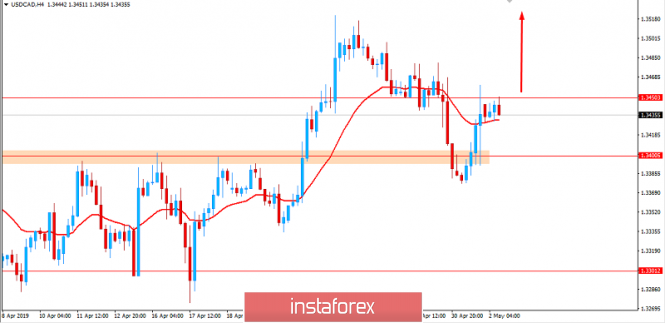

Now let us look at the technical view. The price is currently residing below 1.3450 area after certain retest while being quite corrective and volatile. Though certain bearish pressure is currently observed, a break above 1.3450 with a daily close is expected to lead the price higher with the target towards 1.40 price area in the future. As the price remains above 1.3400 area, the bullish bias is expected to continue further.