USD has managed to gain sustainable non-volatile momentum over CHF recently which is expected to continue. Despite the Fed's dovish sentiment, certain volatility is expected in this pair ahead of the NFP report scheduled for release today.

Today the US Non-Farm Employment Change report is going to be published which is expected to decrease to 181k from the previous figure of 196k. Besides, the Average Hourly Earnings is expected to increase to 0.3% from the previous value of 0.1% and the Unemployment Rate is expected to be unchanged at 3.8%. Though analysts predict a decline in the employment change, the employer activity in April along with the solid economic growth are expected to have positive results. Recently, Fed Chairman Jeromy Powell described the current economic conditions of the US as stronger than expected while the inflation remained sluggish.

Though wage growth is not strong enough to drive up inflation, it can be enough to underpin the economic growth as the stimulus from last year's $1.5 trillion tax cut wanes. The jobless rate, around the lowest in nearly 50 years, is close to the 3.7 percent that Fed officials project it will be by the end of the year.

Additionally, the US-China trade negotiations are still unsettled and due to the conflict in several sectors operating together, the raise in tariffs and involvement in the process are expected to keep the economy under pressure as the foreign trade is challenged at the current global economic scenario.

On the other hand, Switzerland has released worse-than-expected economic reports recently which lead to further weakness of the currency. The Swiss retail sales report was published with a decrease to -0.7% from the previous value of 0.0% which was expected to be at -0.4% while the Manufacturing PMI also decreased to 48.5 from the previous figure of 50.3 which was expected to increase to 51.0.

Today, the Swiss SECO Consumer Climate report is going to be published which is expected to increase to -3 from the previous figure of -4, and the CPI is also expected to decrease to 0.2% from the previous value of 0.5%.

As of the current scenario, CHF is weaker against USD ahead of the NFP report. The US dollar is likely to extend gains if the upcoming economic reports are published better than expected in the coming days.

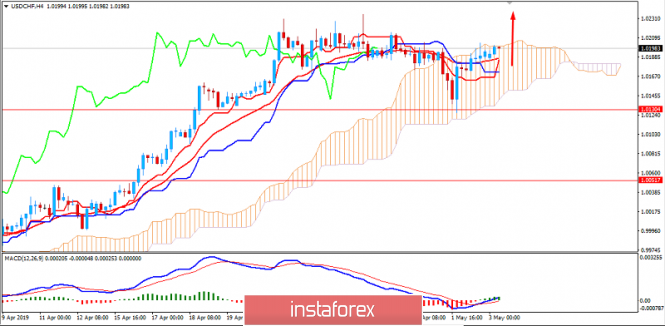

Now let us look at the technical view. The price has formed a V shape bullish reversal recently off the 1.0130 support area. The price is currently being held by the dynamic support area of the Kumo Cloud and crossovers between Tenkan, Kijun and 20 EMA also indicate further upward pressure. As the price remains above 1.00 area with a daily close, further bullish moves with target towards 1.0250 and later towards 1.03 area are expected.