USDJPY managed to regain certain momentum since the bounce off the 109.00 area while being in a preceding bearish trend. JPY struggled to maintain momentum after the release of weak economic data which undermined the market sentiment against USD.

The US economy is slightly affected by the Trade War. Mixed economic reports showed a certain weakness yesterday. Recently, the Fed officials stated that US economic policymakers have changed their view regarding low unemployment rate. Notably, this data did not influence an inflation rate. The Fed official estimated the long-run U.S. unemployment rate at 4.3%. That figure is lower both than their 4.7% estimate two years prior and the actual unemployment rate now, which has edged down to 3.6%.

Federal Reserve Chairman Jeromy Powell recently dismissed the comparison between rising of business debt to record levels in recent years and the condition in US mortgage markets which preceded 2007 to 2009 crisis. Powell pointed to the lack of transparency about the funding sources and ultimate holders of corporate debt, and to risks that any economic downturn could worsen if indebted borrowers begin to fail as reasons for caution. Though growth in corporate debt has slowed lately but another sharp increase could lead to unstable economic situations in the process. That concern is another reason why the Fed may be reluctant to cut interest rates since lower borrowing costs could prompt firms to take on more debt.

This week Core Durable Goods Orders report is going to be published which is expected to decrease to 0.1% from the previous value of 0.3% and Durable Goods Orders report is expected to decrease significantly to -2.0% from the previous value of 2.6%. Today FOMC members Evans and Rosengren are going to speak regarding monetary policy and interest rate decision which might turn out to be neutral with the impact.

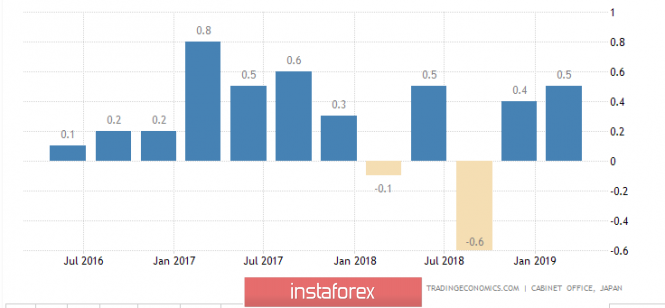

On the other hand, today JPY Prelim GDP Price Index report was published with an increase to 0.2% as expected from the previous value of -0.3%, Prelim GDP remained unchanged at 0.5% which was expected to decrease to -0.1% and Revised Industrial Production report also showed an increase to -0.6% which was expected to be unchanged at -0.9%.