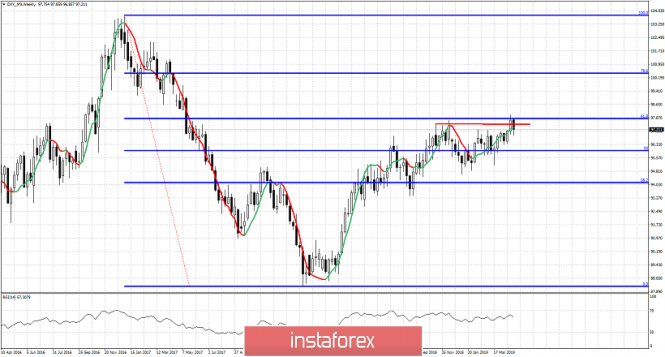

The Dollar index managed to spread enthusiasm among Dollar bulls as last week we saw prices finally break out and above the December 2018 highs. This week however ended with an entire different sentiment.

The Dollar index closed this week below the broken red horizontal resistance canceling the break out we witnessed last week. However not all is lost yet for Dollar bulls. Yes the weekly close is not good for the bullish trend, but price continues to make higher highs and higher lows. The Dollar index continues to trade around the 61.8% Fibonacci retracement of the entire decline. A rejection and bearish reversal from current levels will be confirmed with a break below 95.15. This would have longer-term bearish implications for the index. Until then bulls still hope that the bullish trend will be revived next week and price we recapture the red horizontal resistance trend line. A weekly close above 97.75 will open the way for a move towards 100.45.

The material has been provided by InstaForex Company - www.instaforex.com