Forecast for June 28:

Analytical review of H1-scale currency pairs:

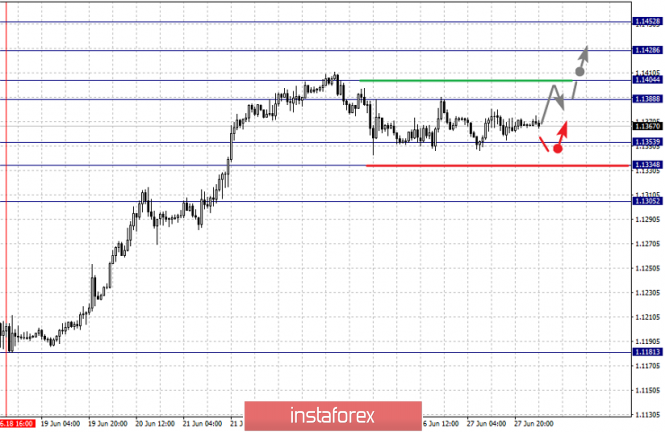

For the euro / dollar pair, the key levels on the H1 scale are: 1.1452, 1.1428, 1.1404, 1.1388, 1.1353, 1.1334 and 1.1305. Here, we continue to follow the development of the ascending structure of June 18. Continuation of the movement to the top is expected after the passage of the price to the noise range 1.1388 - 1.1404. In this case, the target is 1.1428. Consolidation is near this level. For the potential value to the top, we consider the level of 1.1452. After reaching which, we expect a departure to the correction.

Short-term downward movement is possible in the corridor 1.1353 - 1.1334. The breakdown of the latter value will lead to in-depth correction. Here, the goal is 1.1305. This level is a key support to the top.

The main trend is the upward structure of June 18, the stage of correction.

Trading recommendations:

Buy 1.1405 Take profit: 1.1428

Buy 1.1430 Take profit: 1.1452

Sell: 1.1353 Take profit: 1.1335

Sell: 1.1332 Take profit: 1.1305

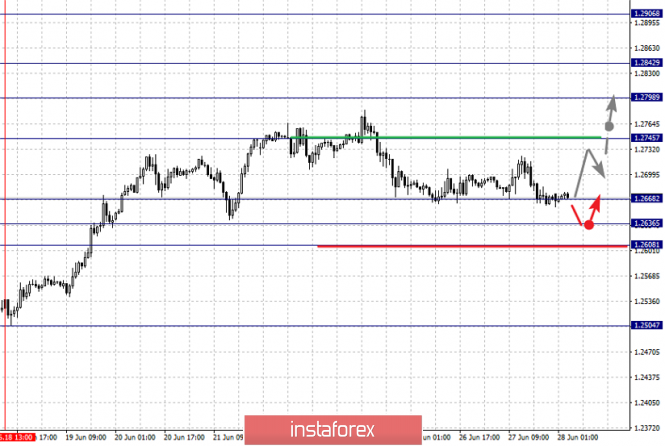

For the pound / dollar pair, the key levels on the H1 scale are: 1.2906, 1.2842, 1.2798, 1.2745, 1.2668, 1.2636 and 1.2608. Here, we are following the development of the ascending structure of June 18. At the moment, the price is in correction and forms the potential for the bottom of June 25. We expect a resumption of the upward movement after the breakdown of the level of 1.2745. In this case, the first target is 1.2798. Short-term upward movement is possible in the range 1.2798 - 1.2842. The breakdown of the latter value will lead to a movement to the potential target - 1.2906. Upon reaching this level, we expect a rollback to the bottom.

Short-term downward movement is expected in the corridor 1.2668 - 1.2636. The breakdown of the last value will lead to a prolonged correction. Here, the target is 1.2608. This level is a key support to the top.

The main trend is the upward structure of June 18, the stage of correction.

Trading recommendations:

Buy: 1.2745 Take profit: 1.2798

Buy: 1.2800 Take profit: 1.2842

Sell: 1.2668 Take profit: 1.2636

Sell: 1.2634 Take profit: 1.2608

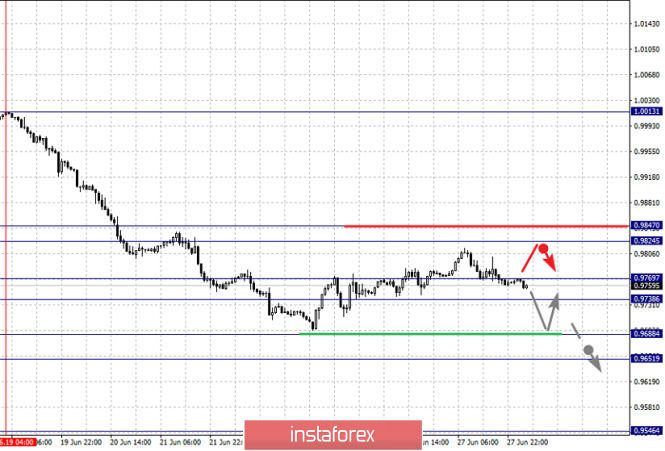

For the dollar / franc pair, the key levels on the H1 scale are: 0.9847, 0.9824, 0.9769, 0.9738, 0.9688 and 0.9651. Here, we are following the development of the downward cycle of June 19. At the moment, the price is in the correction zone. Continuation of the movement to the bottom is expected after the breakdown at level of 0.9688. Here, the potential target is 0.9651. From the corridor 0.9688 - 0.9651, we expect to go to the correction zone.

Consolidation is possible in the corridor 0.9738 - 0.9769. The breakdown of the latter value will lead to the development of a protracted correction. Here, the goal is 0.9824. The range 0.9824 - 0.9847 is a key support for the downward structure. Before it, we expect the initial conditions for the upward cycle.

The main trend is the downward cycle of June 19, the stage of correction.

Trading recommendations:

Buy : 0.9738 Take profit: 0.9767

Buy : 0.9773 Take profit: 0.9824

Sell: 0.9686 Take profit: 0.9653

For the dollar / yen pair, the key levels on the scale are : 108.12, 107.77, 107.15, 106.65, 106.35 and 105.94. Here, the price is in deep correction and forms a pronounced potential for the top of June 25. Continuation of the movement to the bottom is expected after the breakdown of 107.15. Here, the target is 106.65. The breakdown of which, in turn, will allow us to count on the movement to the level of 106.35. Consolidation is near this value. For now, the potential value for the bottom is considered the level of 105.94. After reaching which, we expect to go into correction.

Short-term upward movement is possible in the range of 107.77 - 108.12. The breakdown of the latter value will begin the development of an upward trend on the H1 scale. In this case, the potential target is 108.70. Price consolidation is near this level.

The main trend: the downward cycle of June 17, the formation of potential movement for the top of June 25.

Trading recommendations:

Buy: 107.78 Take profit: 108.10

Buy : 108.14 Take profit: 108.70

Sell: 107.15 Take profit: 106.67

Sell: 106.62 Take profit: 106.37

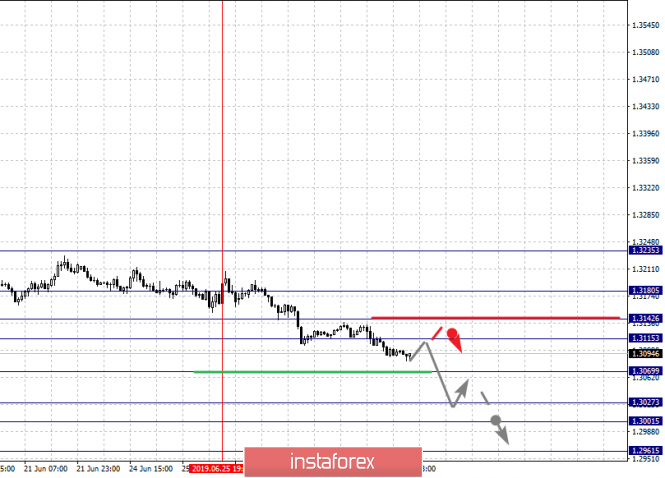

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3180, 1.3142, 1.3115, 1.3069, 1.3027, 1.3001 and 1.2961. Here, we continue to monitor the local downward structure of June 25. Continuation of the movement to the bottom is expected after the breakdown at level 1.3069. In this case, the goal is 1.3027. Price consolidation is in the corridor 1.3027 - 1.3001. For the potential value to the bottom, we consider the level of 1.2961. After reaching which, we expect a rollback to the top.

Short-term upward movement is possible in the corridor 1.3115 - 1.3142. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3180. This level is the key resistance for the development of the upward structure. Its breakdown will allow to count on the movement to the potential target - 1.3235.

The main trend is a local downward structure from June 25.

Trading recommendations:

Buy: 1.3115 Take profit: 1.3140

Buy : 1.3143 Take profit: 1.3180

Sell: 1.3067 Take profit: 1.3027

Sell: 1.3001 Take profit: 1.2961

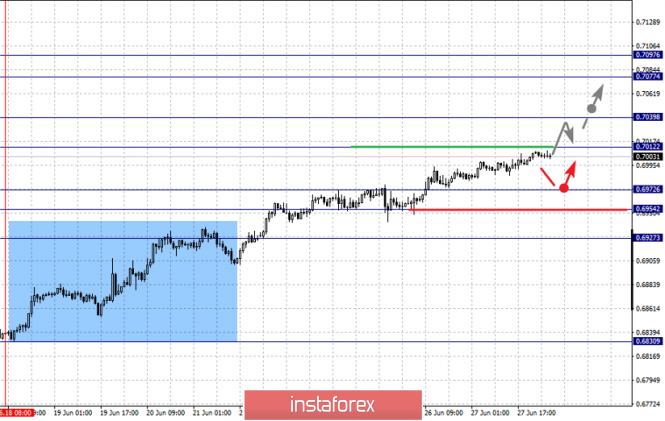

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.7097, 0.7077, 0.7039, 0.7012, 0.6972, 0.6954 and 0.6927. Here, we are following the development of the ascending structure of June 18. Continuation of the movement to the top is expected after the breakdown at the level of 0.7012. In this case, the goal is 0.7039. Price consolidation is near this level. The breakdown of the level of 0.7040 must be accompanied by a pronounced upward movement. Here, the goal is 0.7077. For the potential value to the top, we consider the level of 0.7097. Upon reaching this level, we expect consolidation in the corridor of 0.7077 - 0.7097, as well as a rollback to the bottom.

Short-term downward movement is possible in the corridor 0.6972 - 0.6954. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.6927. This level is a key support to the top.

The main trend is the upward structure on June 18.

Trading recommendations:

Buy: 0.7012 Take profit: 0.7037

Buy: 0.7041 Take profit: 0.7077

Sell : 0.6972 Take profit : 0.6955

Sell: 0.6952 Take profit: 0.6930

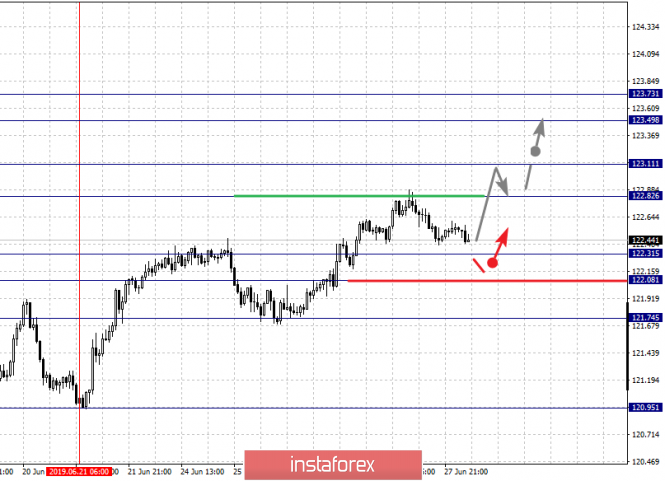

For the euro / yen pair, the key levels on the H1 scale are: 123.73, 123.49, 123.11, 122.82, 122.31, 122.08 and 121.74. Here, we are following the development of the ascending structure of June 21. Continuation of the movement to the top is expected after the breakdown of 122.82. In this case, the goal is 123.11. Near this level is price consolidation. The breakdown of the level of 123.11 should be accompanied by a pronounced upward movement to the level of 123.49. We consider the level 123.73 to be a potential value to the top. After reaching which, we expect consolidation, as well as a rollback to the bottom.

Short-term downward movement is expected in the corridor 122.31 - 122.08. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 121.74. This level is a key support for the upward structure.

The main trend is the upward structure of June 21.

Trading recommendations:

Buy: 122.82 Take profit: 123.10

Buy: 123.14 Take profit: 123.49

Sell: 122.30 Take profit: 122.10

Sell: 122.06 Take profit: 121.76

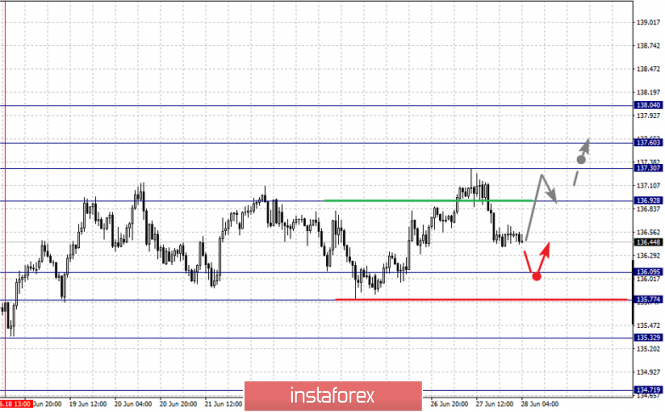

For the pound / yen pair, the key levels on the H1 scale are : 138.04, 137.60, 137.30, 136.92, 136.09, 135.77 and 135.32. Here, we continue to monitor the formation of the potential for the top of June 18. For the continuation of the movement and the potential value to the top, we consider the level of 138.04. The movement to which is expected after the breakdown of 137.60.

Short-term downward movement is possible in the range of 136.09 - 135.77. The breakdown of the latter value will lead to the formation of a downward structure. Here, the potential target is 135.32.

The main trend - the formation of potential for the top of June 18.

Trading recommendations:

Buy: 136.92 Take profit: 137.30

Buy: 137.32 Take profit: 137.60

Sell: 136.09 Take profit: 135.77

Sell: 135.76 Take profit: 135.34

The material has been provided by InstaForex Company - www.instaforex.com