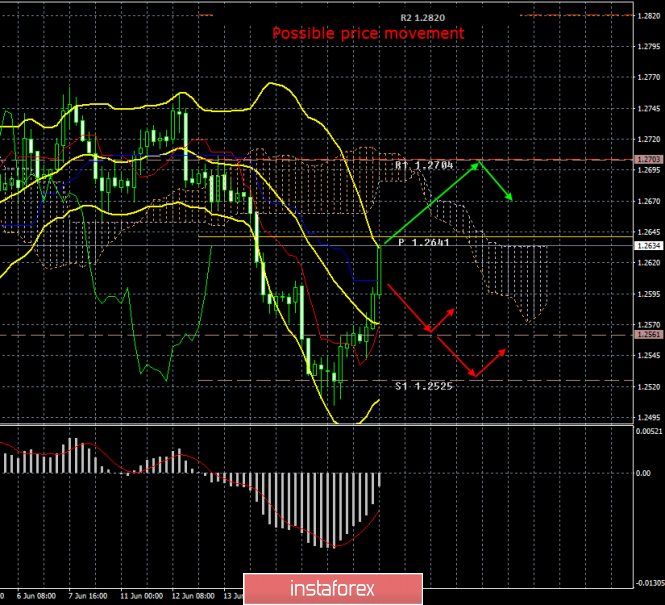

4-hour timeframe

The amplitude of the last 5 days (high-low): 77p - 46p - 102p - 76p - 59p.

Average amplitude for the last 5 days: 72p (73p).

The British pound sterling shows an enviable growth against the US currency on the eve of the announcement of the results of the Fed meeting and the speech of Jerome Powell. It is even difficult to assume what has caused such a sharp strengthening of the British currency, which has lately been falling almost non-stop. No encouraging news on Brexit has been reported to the press today. In the UK today, Boris Johnson won the second round of elections for the prime minister post and immediately received the support of Dominic Raab, ex-Minister for Brexit issues, who said that now the only candidate who can provide Brexit until October 31 is Johnson. By the end of May, inflation in the UK slowed down to 2.0% y/y, which is fully consistent with the forecast values. Thus, at the moment we see no weighty reasons for the market to make such strong purchases of the British pound. On the other hand, perhaps it's not a matter of buying the pound sterling, but rather closing short positions before the results of the FOMC meeting are released. Traders got bogged down in dollar positions lately, but before such an important event as the Fed meeting, waiting for a dovish rhetoric from Powell, they began to simply close their shorts. That is what led to an impressive increase in the pound. Such an explanation seems most plausible to us. Now the only thing that remains is to figure out how the market will react to evening events. The rate is unlikely to be changed today. Traders do not react to the words of Donald Trump, in which he criticizes Powell, Draghi and the Bank of China for not adhering to the right US monetary policy. Thus, it remains to be seen whether the rate cut will be announced today in 2019, what will be the forecasts for the main macroeconomic indicators for 2019-2020 and what Powell will be in tune with. The more dovish he is, the more likely it is that the pound will strengthen. However, everything could be different here: as the pound rises in price in the morning, if the assumption of a dovish rhetoric turns out to be true, then the market will have nothing to react to. Thus, the market has already worked out the weakness of Powell's statements in advance.

Trading recommendations:

The pound/dollar currency pair started a strong correction. The next goal for the short – 1,2561 and 1,2525 and we recommend them to buy long after the Fed meeting, if the pair remains below the Kijun-sen line and will rebound from it.

Theoretically, it will be possible to buy the British currency when the pair has consolidated above the Kijun-sen line. However, even taking into account the strong upward movement, the bulls' positions still appears very weak today.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen - the red line.

Kijun-sen - the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dotted line.

Chikou Span - green line.

Bollinger Bands indicator:

3 yellow lines.

MACD Indicator:

Red line and histogram with white bars in the indicator window.

The material has been provided by InstaForex Company - www.instaforex.com