4-hour timeframe

Technical details:

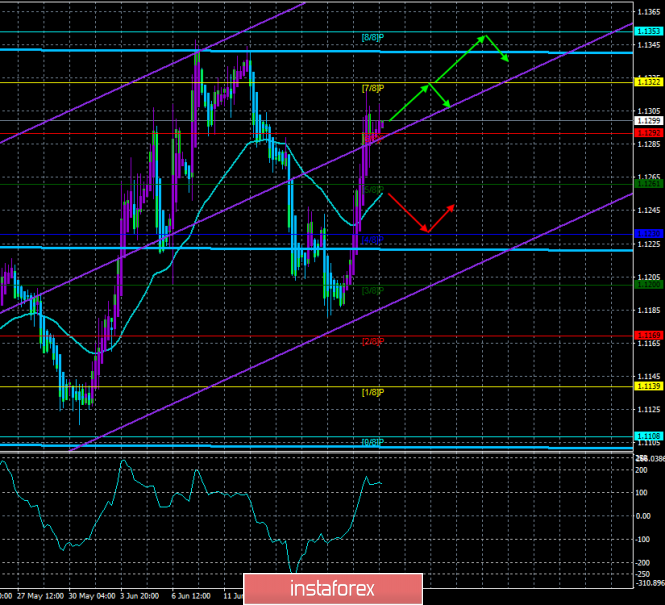

Older linear regression channel: direction - sideways.

Younger linear regression channel: direction - up.

Moving average (20; smoothed) - up.

CCI: 133.0050

By and large, the upward movement in the EUR/USD pair ended yesterday with the start of the US trading session. The markets have fully worked out all the information received from Mario Draghi, who spoke at the ECB forum, and Jerome Powell. The last trading day of the week is an excellent reason for fixing positions on the euro and for correction. Today, we only note preliminary values of the index of business activity in the manufacturing and services sectors from Markit as fundamental events for the USA and the European Union in June. Despite the fact that these are only preliminary values and June is not over yet, this data may cause traders to react if they differ too much from the predicted values. We remind you that the production IDA in Europe feels very bad and went below the level of 50, above which it can be concluded that there is revenge to be the growth of the industry. In America, the situation is slightly better. All three indices are above 50.0, but not very far from it. Potentially, any of the IDA may slip under this level in the near future. in turn, this will give traders a reason to talk again about the recession and that in America "everything is bad". In any case, we recommend paying attention to these reports today. From a technical point of view, the correction is ongoing while the prospects for the euro remain dim. There is only one chance for the euro currency to continue strengthening. If the US continue to disappoint with their macroeconomic statistics, it will give traders a reason to talk again about recession and that "everything is bad" in America.

Nearest support levels:

S1 - 1,1292

S2 - 1.1261

S3 - 1.1230

Nearest resistance levels:

R1 - 1.1322

R2 - 1.1353

R3 - 1.1383

Trading recommendations:

The EUR/USD currency pair keeps moving upward, as evidenced by Heiken Ashi. Thus, it is now recommended to hold long positions with targets of 1.1322 and 1.1353 until Heiken Ashi turns down.

It is recommended to sell euros after traders fix a pair below the moving average line, which will change the downward trend, with the first targets of 1.1230 and 1.1200.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanations for illustrations:

The older linear regression channel is the blue lines of unidirectional movement.

The younger linear regression channel is the violet lines of unidirectional movement.

CCI - blue line in the indicator window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

The material has been provided by InstaForex Company - www.instaforex.com